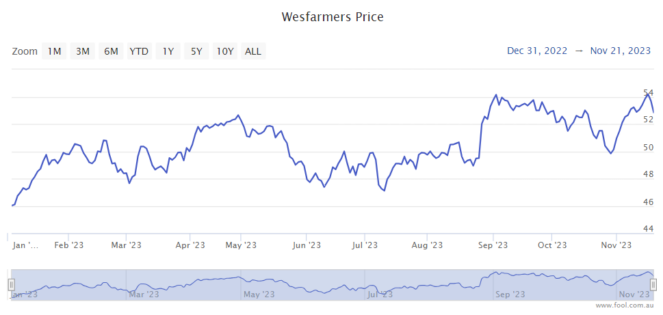

The Wesfarmers Ltd (ASX: WES) share price has seen plenty of volatility this year, as we can see on the chart below. Can the company finish the year on a high and reach a share price of $55?

The Wesfarmers share price hasn't been above $55 since early January 2022 – almost two years ago! It's understandable why there has been plenty of investor uncertainty since 2021 considering all of the interest rate rises and inflation since then.

As a reminder, Wesfarmers is the business behind Bunnings, Officeworks, Kmart and plenty more.

I want to point out that investors shouldn't focus too much on a short-term timeframe like one month. But, it could be useful to consider the outlook of the business and look at where brokers believe the company might go from here.

UBS views on the ASX share

The broker points out that Bunnings and Kmart are projected to make around three-quarters of the underlying earnings before tax (EBT) in FY24 for the company, which are key for Wesfarmers shares. The chemicals, energy and fertilisers (WesCEF) division is predicted to make 13% of underlying EBT.

After looking at the commentary from the annual general meeting (AGM), UBS noted that both Bunnings' DIY and trade demand had seen FY24 sales growth in the year to date, though consumers are "cautious on the big ticket, yet participating in smaller projects and repair & maintenance."

UBS also said that "Kmart remains well positioned to profitably gain share as its offer resonates given cost of living pressures remain pronounced."

However, UBS is less optimistic on lithium over the rest of the decade, which could lower WesCEF earnings compared to previous estimates because of its exposure through Mt Holland. Even so, the introduction of Mt Holland earnings is expected to be a boost to WesCEF and Wesfarmers profit compared to FY23.

Wesfarmers share price target

The current UBS price target on Wesfarmers is $56, which is a forecast of where the Wesfarmers share price might be in 12 months. In other words, the investment analysts do believe the Wesfarmers share price can reach $55 and slightly higher, but it might take longer than a month to get there.

UBS has estimated that Wesfarmers can generate $2.21 of earnings per share (EPS) in FY24 and $3.03 of EPS by FY28. This would put the current Wesfarmers share price at 24 times FY24's estimated earnings and 17 times FY28's estimated earnings.

The broker has estimated that Wesfarmers could pay a grossed-up dividend yield of 5.7% in FY24 and 8% in FY28.