Sure, a million bucks no longer gets you an average house in Sydney.

But becoming a millionaire still has a ring to it, right?

The fact is you can still do plenty with a cool mill in the bank — not least retire on a comfortable lifestyle.

And I can tell you the dream is within reach if you invest in ASX shares and use the power of compounding.

Here's a hypothetical.

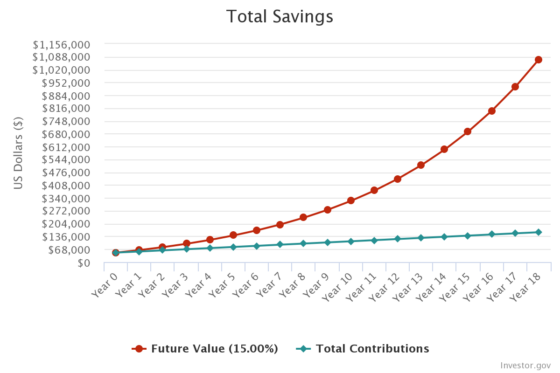

Let's say you have $50,000 saved to start a stock portfolio. For the sake of easy maths, let's say you add $500 to that each month.

If your stocks can pump out a compound annual growth rate (CAGR) of 15%, you will be a millionaire after 18 years.

That is, if you started at 30 years old, you can tell your boss where to go at 48.

Three growth shares that could have made you a million

Now, what sort of ASX shares could you achieve 15% CAGR?

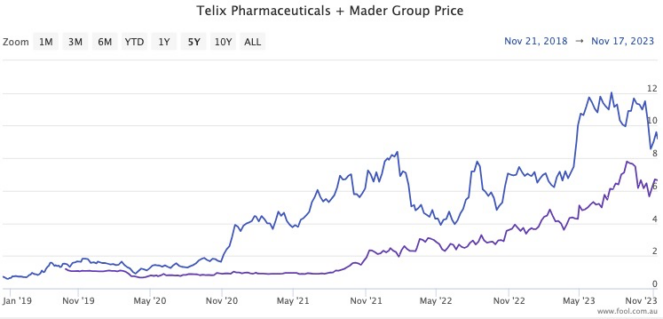

Here are three examples that experts are currently urging punters to buy: Mader Group Ltd (ASX: MAD), Telix Pharmaceuticals Ltd (ASX: TLX) and Patriot Battery Metals Inc CDI (ASX: PMT).

Mader, which provides maintenance services for mining clients, listed on the ASX in October 2019 after issuing shares at $1 during its initial public offering (IPO).

The stock is now trading around $6.40, making it better than a six-bagger in about four years, or an eye-popping CAGR of 59%.

Telix Pharmaceuticals makes cancer diagnostic and treatment products. As some of its innovations have gone through testing, approvals and commercialisation, the stock price has rocketed 1,194% over the past five years.

That equates to a CAGR of 66.77%.

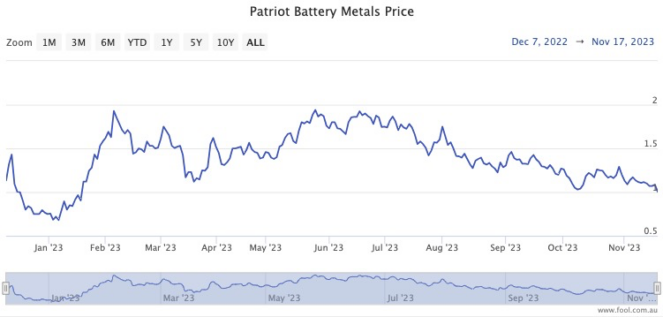

Patriot Battery Metals is in the business of finding sources of lithium.

The Canadian company sold its shares at 60 cents during its IPO, then floated in December last year. Patriot Battery Metals shares are now trading around the $1 mark, making it a 67% gain over 11 months.

Experts think there's more to come from the trio

Of course, past performance is never an indicator of the future. Therefore all this phenomenal performance doesn't mean that's how well they will do in the coming years.

But I present them to you to demonstrate that forming a portfolio with 15% CAGR to make a million is not an impossible task.

Also, experts still seem to be pretty bullish on all three of our examples, so at least they think they have a reasonable chance of continuing their bull run.

According to CMC Markets, four out of five analysts that cover Mader Group are rating it as a buy right now.

Meanwhile, all seven analysts that study Telix reckon it's an add, and same with all nine professionals that cover Patriot Battery Metals.