The Lake Resources Ltd (ASX: LKE) share price has been under intense pressure over the last year. As a result, the lithium explorer's shares are now a shadow of what they once were, racking up an explosive 92% dumping from their April 2022 highs.

At one point, the upcoming lithium explorer boasted a market capitalisation of nearly $4 billion. However, a lowered production forecast and cratering commodity prices have taken their pound of flesh, reducing Lake Resources to a valuation of $241 million.

Now worth a fraction of its former self, has the Lake Resources share price reached rock bottom, or are there more lashings ahead?

Is there more downside for Lake Resources shares?

Straight off the bat, I have no special fortune-telling abilities. Where the Lake Resources share price goes from here is anyone's guess. However, we can form an educated view based on the available information.

Two key factors will arguably drive shares in this ASX lithium company in the medium term: the lithium price and project development. Shares in established mining companies tend to move based on production and profits, but Lake Resources is not yet at that stage.

Instead, Lake is busily working on assessing and developing its first site, the Kachi project. Hence, investors will likely be keeping close tabs on the feasibility and financing of the Argentina-based deposit.

On 31 October, Lake Resources presented at the International Mining and Resources Conference (IMARC). Attendees were reminded that the company targets lithium carbonate production in the third quarter of 2027 — four years from now.

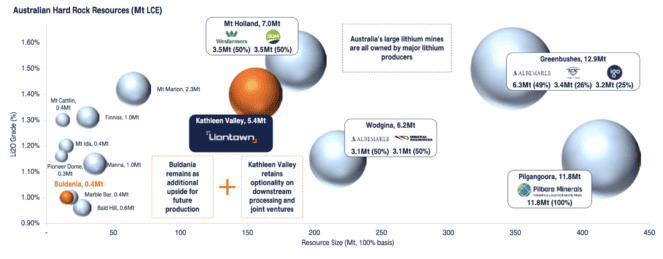

The wait might be worth it if the estimated resource size is accurate. Lake believes Kachi holds 2.9 million tonnes of lithium carbonate equivalent, ranking it above Mineral Resources Ltd's (ASX: MIN) Mt Marion mine, as shown above.

However, it also infers a long — likely costly — road still to conquer before Lake Resources reaches production. The downside risk is in meeting the funding (and associated costs) over the next four years.

The company's latest quarterly report noted seven full quarters' worth of funding. If you disregard the available debt portion, relying solely on cash, Lake Resources would have one full quarter of juice in its tank.

The argument for buying now

One could argue now is the time to pull the trigger on Lake Resources shares despite the execution risk ahead, namely because of the rampant consolidation taking shape in the lithium industry lately.

Recent weeks have witnessed billionaires and big corporations buying up ASX lithium shares in droves. Liontown Resources is a prime example of a pre-production lithium company attracting a $6.6 billion takeover bid, which has since fallen through.

It's worth noting that most of the interest surrounds Australian-based deposits. In comparison, Lake Resources is situated in Argentina — another jurisdiction that supports mining developments but perhaps not as attractive as outside investors see Australian projects.

What I'm waiting to see

Personally, I'm holding out to review the company's phase 1 definitive feasibility study slated for release next month. This document should shed further light on the economics and estimated costs of bringing Kachi to life.

At this stage, plenty of unknowns make it incredibly hard to value Lake Resources shares. For now, I'm putting this ASX lithium share into my 'too-hard' pile, as Warren Buffett would say. That isn't to say the company can't succeed.