The Azure Minerals Ltd (ASX: AZS) share price has performed phenomenally over the past 12 months.

Already surging from high-grade lithium intersections found at its West Pilbara lithium project (Andover) in June, Azure shares have rallied since October amid a takeover offer from Sociedad Química y Minera de Chile S.A. (NYSE: SQM) — one of the world's largest lithium miners.

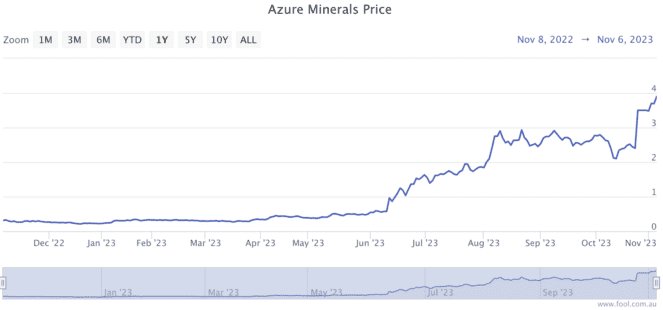

The meteoric rise in Azure Minerals shares has generated a monstrous 1,106% return in the last year, as shown by the chart below.

However, speculation is arising over the potential derailment of SQM's bid, causing some to wonder whether this ASX lithium share could be walking a similar path to Liontown Resources Ltd (ASX: LTR).

Deep pockets buying Azure Minerals shares

Wasting no time, Australian mining magnate Gina Rinehart accumulated a stake in Azure Minerals the day after SQM entered into a binding transaction implementation deed.

Purchased through Hancock Prospecting, Rinehart grabbed ahold of an ~18% stake in Azure on 27 October. The sudden sizeable investment emulated that of the billionaire acquiring roughly 18% in Liontown Resources while being courted by lithium giant Albermarle Corporation (NYSE: ALB) last month.

Then, Mineral Resources Ltd (ASX: MIN) founder and managing director Chris Ellison joined the party last week. Adding another lithium-dipped feather to his cap, so to speak, Ellisons' MinRes gobbled up 12.3% of Azure Minerals shares on 1 November.

In addition, the highly successful Mark Creasy holds nearly a 13% stake in Azure through his Yandal Investments.

When all tallied up, the three billionaires and SQM hold 62.2% of Azure Minerals shares.

What could unfold?

Usually, a takeover — and the sometimes ensuing bidding war — is a boon for the target's share price. That is arguably the case for Azure, with its shares swapping hands at $3.89, a 10.5% premium to the Chilean miner's offer of $3.52 per share.

That being said, it failed to pan out positively for Liontown shareholders due to the 'growing complexities' associated with large stakes held by potentially unaligned parties. The Liontown Resources share price has plummeted 42% following the withdrawal of its takeover bid, as shown below.

For Azure, it may mean the deal evolves into a joint venture between SQM, MinRes, and Hancock Prospecting. Highlighting this option, Commodity Discovery Fund analyst Samson Li recently said:

A joint venture could work well with Mineral Resources' experience in Australia's lithium space and Gina Rinehart's capital.

Alternatively, others speculate it could mean any deal involving SQM is dropped entirely — similar to what occurred between Albermarle and Liontown.

Under the existing agreement, SQM can withdraw from its offer if another party accumulates a stake of 19% or more.