The battle between the bulls and bears for ASX shares continues in earnest this week.

To help decide which side you might belong to, eToro market analyst Josh Gilbert has flagged three developments over the next few days that will have the biggest bearing on ASX shares:

1. Australia unemployment

Jobless queues are a major barometer of economic health, and all eyes will be on the latest numbers coming out Thursday.

Will the unemployment numbers rise enough for the Reserve Bank to stop raising interest rates?

Gilbert is pessimistic.

"Employment looks set to remain robust, with unemployment figures lingering near record lows and net employment additions expected to be solid."

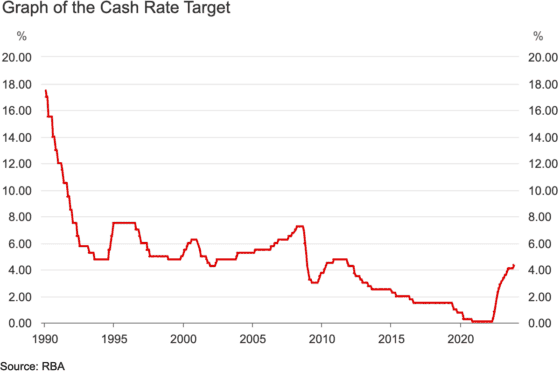

He adds though that the RBA realises higher unemployment is "on the horizon" as the impact of 13 rate hikes is still cascading out into the economy.

"Migration is high, and data from Seek Ltd (ASX: SEK) this week showed job adverts are falling.

"While November's reading is unlikely to be the first time we see a sharp increase in the unemployment figures, it's hard to see levels remaining low far into 2024."

2. Australia consumer confidence

The latest Westpac Banking Corp (ASX: WBC) consumer sentiment report is due out Tuesday.

Gilbert forecasts that confidence will be rock-bottom after the 13th rate hike delivered on Melbourne Cup day.

"This latest move from the RBA will undoubtedly put pressure on households, especially as savings continue to evaporate just ahead of an expensive time of year."

The cost-of-living crisis is putting the heat on the federal government to reconsider rolling out stage three tax cuts.

"The planned cuts to tax for high-income earners would likely cause a boost to retail sales and consumer confidence while doing little to ease the pressure felt by mortgage holders and renters."

3. Chinese tech giants earnings

Two technology giants in the world's biggest country will be reporting this week on their latest financial performance.

According to Gilbert, it's been "a pretty miserable year" for Alibaba Group Holding Ltd (HKG: 9988) and Tencent Holdings Ltd (HKG: 0700) as they languish while their US counterparts have soared.

"China's struggling economy has weighed on these companies despite the relaxation of regulations from Chinese authorities.

"Alibaba's future may be looking brighter, however, with recent news from CEO Eddie Wu indicating the company aspires to become an open tech platform and provide infrastructure for AI innovation and transformation in thousands of industries."

Alibaba shares are down about 10% year to date, while Tencent has lost 7.8%.

Gilbert pointed out that the "depressed valuations" could be a buying opportunity for "contrarian investors".

"A strong set of results next week, alongside solid forecasts, could be the tailwind these tech giants need to get a leg up in this market."