You might think a $20,000 stock portfolio is modest, but that can be a powerful start that could turn into something really special.

Riding the long-term tendencies for share markets to rise, you could easily end up with $10,000 of annual passive income.

That's a nice boost to your bank account for doing nothing.

Think of it as a free overseas holiday each year!

There are many paths to get to that destination, but here's one way I would work the $20,000 portfolio:

How to convert $20,000 into $100,000

Initially $20,000 is simply not large enough to generate $10,000 of yearly passive income.

So we need to grow this portfolio.

With the magic of compounding and regular additions from your savings, this can be done in reasonable time.

I would do this with a diversified portfolio of ASX growth shares.

I like that approach because it saves the headache of continually reinvesting dividends and all the tax complications associated with that.

Examples of growth stocks that experts are keen on at the moment are IPD Group Ltd (ASX: IPG) and Mader Group Ltd (ASX: MAD).

IPD shares have gone gangbusters since listing in December 2021, more than tripling the initial public offering (IPO) issue price.

The Mader Group has been even more impressive after it sold $1 shares at its IPO before floating in October 2019.

The shares are now going for high $6s, making it a six-bagger in just four years for those lucky investors.

Let's be clear though. Not every stock you buy will be as successful as these ones. But if you diversify well enough, you will have such bolters mixed with some flat ones and some loss makers.

If that portfolio can average out to a compound annual growth rate (CAGR) of 10%, you're cooking with gas.

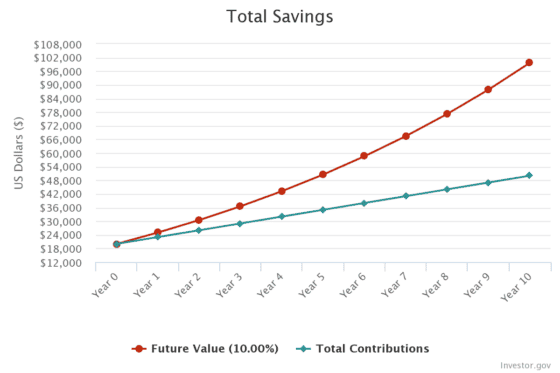

That $20,000 nest egg you started with, with $250 added each month and growing at 10% a year, will be very close to six figures after 10 years.

Now it's time to harvest that passive income you always wanted.

Passive income, here we come

The simplest way to start getting cash into your bank account is to sell off the capital gains each year.

If that portfolio can maintain the 10% CAGR, that's $10,000 of annual passive income right there.

However, we all know stock markets can fluctuate wildly from year to year, especially growth shares.

That means some years you might see no passive income or in others you may receive a massive windfall.

So the alternative is to sell off all the growth shares and reconstruct the $100,000 portfolio with a bunch of ASX dividend shares that average out to yield 10% per annum.

While there are no guarantees in investing, this might provide a more stable source of passive income.

With this method the income could also come with some tax advantages, as you receive franking on many of those stocks.

This is where some professional advice could come in handy, so that you can choose the best income production machine according to your personal circumstances.