Wesfarmers Ltd (ASX: WES) is one of the largest companies one can invest in on the ASX.

To be precise, it is the 11th biggest business listed on the ASX by market capitalisation, at just under $60 billion.

The conglomerate is best known in the public consciousness for ubiquitous retail chains like Kmart, Target, Officeworks and Bunnings. It also operates businesses in unrelated fields such as chemicals, mining and industrial safety.

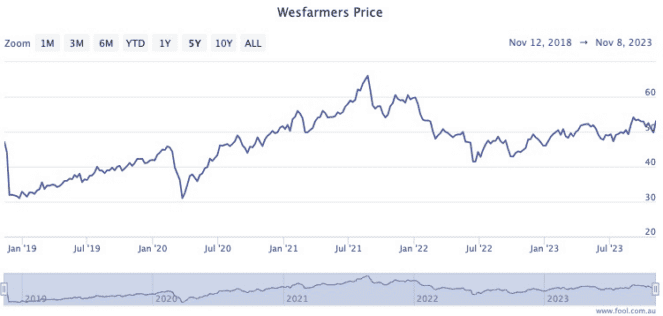

But for such a mature company, the valuation has grown pretty well in recent times. Wesfarmers shares are now trading more than 56% higher than they were five years ago.

That's all while paying out a decent, fully franked dividend yield of 3.6%.

So is it now fully priced, or is there plenty of juice left for investors that buy now?

The stock that 'everyone should own'

Professional investors are divided, but as a group, they lean towards buying.

CMC Markets currently shows seven out of 16 analysts rating Wesfarmers as a buy, while five think it's a hold, and four recommend selling.

The Motley Fool columnists Sebastian Bowen and Tristan Harrison are both fans, separately expressing their bullishness this month.

Bowen called it one of those stocks that "everyone should own".

"Wesfarmers has proven itself to be an astute manager of capital over many decades now. This is reflected in the company's share price, as well as its healthy dividends."

According to Harrison, Wesfarmers shares are an ideal starter for a new portfolio.

"I think it can keep performing as it expands its store network and makes bolt-on acquisitions (such as Beaumont Tiles). It's also expanding into areas with an attractive long-term outlook, such as lithium and healthcare.

"Wesfarmers has already been around for many decades, and I think it will be successful for many years to come."

Retailers that Aussies still shop at during tough times

Morgans has Wesfarmers on its Best Ideas list this month, as it reckons its range of budget retailers can withstand an economic downturn.

"The company is run by a highly regarded management team and the balance sheet is healthy," read its notes.

"We believe Wesfarmers' businesses, which have a strong focus on value, remain well-placed for growth and market share gains in a softening macroeconomic environment."

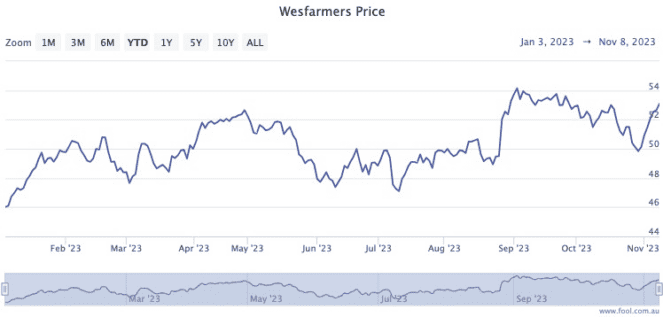

Wesfarmers shares are 17% up so far this year, and have rocketed 6% over the past 10 days.