Commonwealth Bank of Australia (ASX: CBA) shares have dipped into the red.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $100.42. In morning trade on Tuesday, shares are swapping hands for $99.70 apiece, down 0.72%.

For some context, the ASX 200 is down 0.25% at this same time.

That's how CBA shares and the broader market are faring this morning.

Now, here's why this stockholder is demanding the big bank's directors fork over $2 million.

Why are ASX 200 bank's directors being asked for $2 million?

CommBank was one of a number of high-profile corporations to make a sizeable donation to the Indigenous Voice to Parliament Yes23 campaign in last month's referendum.

In CBA's case, that donation amounted to $2 million.

With more than 60% of voters ultimately voting 'no' to the Voice, the board's decision to make that donation without first seeking CBA shareholder approval is being called into question.

As The Daily Mail reports, CBA shareholder Alexander Haege has written to the Australian Securities and Investments Commission (ASIC) following a dispute over the donation with CommBank chair Paul O'Malley at the bank's AGM in October.

According to Haege, the Corporations Act does not contain a provision "for any company to make political donations on behalf of the company or on behalf of shareholders".

During the AGM, Haege asked O'Malley to point out the "relevant section of [the] Corporations Act that authorises the board to make a political donation to the Voice's YES campaign".

When O'Malley failed to do so, Haege said that was because it was not an "authorised expense". He moved to have the directors repay the $2 million personally rather than have it indirectly funded via CBA shares.

Haege said O'Malley wouldn't put his amendment to a vote, and that his microphone was then turned off.

"The Board of Directors of the CBA is not much interested in hearing any criticism from the company's owners," Haege wrote to ASIC.

He added:

If the Board of Directors wish to make donations to one cause or the other then they must do so from their own generous emoluments. In other words, out of their own pockets. This is the Commonwealth Bank, not a 'piggy bank'.

Addressing CBA's $2 million donation to the Yes campaign at last month's AGM, O'Malley said:

We see it as a policy item, not a political item, from a CBA perspective. Our own experience has been that listening to Indigenous voices has improved the way we support First Nations customers, employees and community members.

How have CBA shares been tracking?

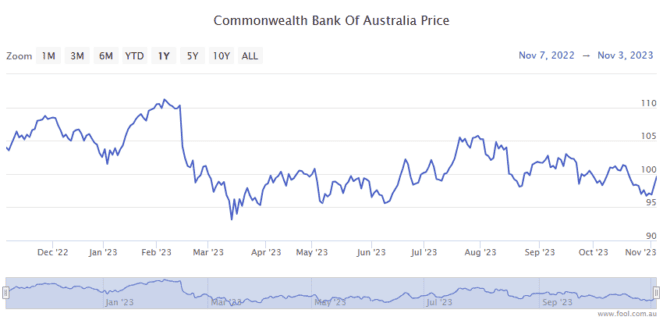

CBA shares are down 1% year to date.

Longer term, the bank's shares are up 42% over five years.