ASX lithium shares may be the hot investment theme of the past few years, but 2023 has not been the best time for them.

China's lagging economy and rapid interest rate rises in western countries have seen prices for the battery ingredient decline. Subsequently valuations for lithium producers have also taken a bath.

However, many experts reckon lithium still has a bright future in the long run.

Demand will pick up once again when the global economy recovers and the pace of transition to net zero accelerates.

The adoption of electric vehicles will be a huge driver, with many petrol cars out there needing to be replaced.

Meanwhile, there are only a finite number of lithium mines and production capacity.

So for those investors with long-term horizons, here's a pair of lithium stocks that experts are bullish on right now:

Production growth + 'a near-term catalyst' = buy

The Allkem Ltd (ASX: AKE) share price has plunged more than 42% since mid-July.

Sequoia Wealth Management senior wealth manager Peter Day is still a fan of the company, which extracts lithium from brine in Argentina and hard rock in Australia.

Production is going well, so in the long run its earnings are likely to increase.

"At the Olaroz [Argentina] facility, lithium carbonate sales volumes of 4,554 tonnes for the September quarter were up 22% on the prior corresponding period," Day told The Bull.

"Mt Cattlin posted record quarterly production of spodumene concentrate."

Allkem is also in the process of a merger with US lithium miner Livent Corp (NYSE: LTHM).

"Updates on the merger proposal with Livent Corporation present a near-term catalyst for Allkem."

Day is not the only professional investor with his eyes on these lithium shares.

CMC Markets currently shows a whopping 13 out of 18 analysts rating Allkem as a buy.

'Opportunity to buy this quality and well-managed company'

Seneca Financial Solutions investment advisor Arthur Garipoli's lithium tip is Mineral Resources Ltd (ASX: MIN), which also produces iron ore.

He noted how the company recently reiterated its volume guidance for the current financial year.

"Mining services production volumes of 66 million tonnes in the first quarter of fiscal year 2024 were up 14% on the prior quarter."

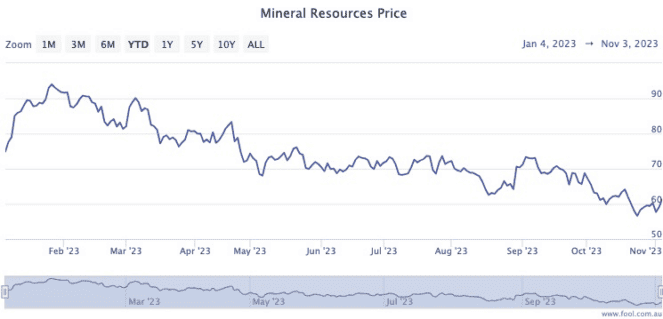

The share price has slumped more than 36% since 24 January, or 17% since 3 September.

"The recent sell off in the lithium sector gives investors an opportunity to buy this quality and well-managed company at a relatively attractive price," said Garipoli.

"We expect continuing news flow involving the acquisition of the Bald Hill lithium mine."

MinRes is also commanding attention with the professional community.

A definitive 13 out of 18 analysts currently consider the mining stock a buy right now.