It's a huge week for ASX shares.

eToro market analyst Josh Gilbert has the lowdown on the three biggest catalysts to watch in the coming days:

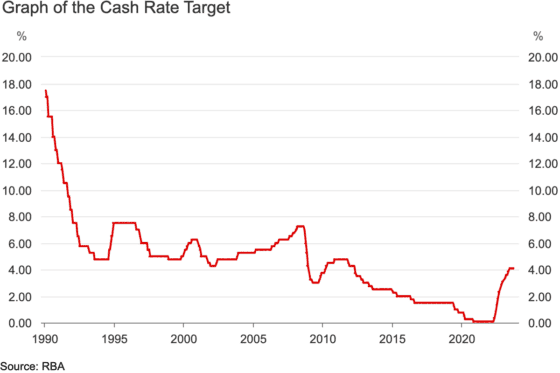

1. Reserve Bank interest rate decision

It's a no-brainer as to what will be the most critical factor for ASX shares this week.

Tuesday afternoon, just before the entire country watches the Melbourne Cup, the Reserve Bank of Australia board will hand down its latest cash rate decision.

According to Gilbert, financial markets have priced in a 53% chance interest rates will rise by 25 basis points.

"After the trifecta of sticky underlying inflation, hotter-than-expected retail sales, and unemployment remaining near record lows, there's a strong chance the RBA will hike rates again when they meet on cup day."

He reckons now it's just a matter of whether we see one or two hikes before Christmas.

"Elsewhere, central banks like the [US] Federal Reserve are winding down their tightening cycles, leaving Australia the odd one out."

The boffins from the International Monetary Fund are currently visiting Australia, and they have been making their feelings known publicly.

"The global financial body has added to the pressure for the RBA to hike, but not without also pointing the finger at state and federal Governments, insisting more needs to be done on a policy level to complement the impact of rate hikes."

2. China inflation

China's monthly consumer price index figures will come out on Thursday.

Gilbert thinks it likely that the struggling Chinese economy has "bottomed out".

"While better news may be on the horizon, PMI data this week showed that it will be a rocky road to recovery," he said.

"Recent policy support in the form of additional sovereign debt and raising the budget deficit ratio is a step in the right direction, but it's not a quick fix and will take time to pay off."

The market is expecting inflation to come in at 0.2% this week.

"With the positive impact of policy stimulus, a broad increase in demand will take time to build momentum, meaning inflation will continue to hover near 'deflation territory'."

3. Xero half-year results

Also on Thursday, one of the market barometers, Xero Limited (ASX: XRO), will report its latest numbers.

Gilbert noted how new chief executive Sukhinder Singh Cassidy promised to steer the ship towards profitability and away from growth at all costs.

"Given Cassidy's commitment, expectations will be high heading into Xero's H1 results," said Gilbert.

"There will be little margin for error as well, given shares have climbed by 58% in 2023, and investors will be expecting additional decent returns."

The report will be a huge milestone in the history of the New Zealand software company, as it'll be the first without the official involvement of founder Rob Drury.

"Drury retired from the board after the company's annual meeting in August, closing out close to two decades with the company.

"Despite this, Drury has committed to continuing to support Cassidy and with Xero's subscriber base still growing across the globe, the future looks bright for Xero."