I view Warren Buffett as one of the world's greatest investors. He has delivered excellent returns over an extraordinary length of time.

There are plenty of great businesses within the S&P/ASX 200 Index (ASX: XJO), but compelling Warren Buffett-style stocks can also be found outside of the biggest ASX 200 stocks.

There are a number of things that Warren Buffett likes to look for, including companies whose management are the founders or those with an ownership mentality. He also likes to look for businesses with long-term growth potential. There are plenty of other factors, but I'm going to focus on these two elements in this article.

Nick Scali Limited (ASX: NCK)

Berkshire Hathaway – Warren Buffett's business – actually operates a few different furniture businesses, including the Nebraska Furniture Mart and Star Furniture. I think there would definitely be space in a Warren Buffett stock portfolio for a furniture business like Nick Scali.

The retail company has Anthony Scali at the helm, and with the Scali name attached, he has a lot of reputational (and financial) skin in the game.

Nick Scali is known for selling quality furniture for good value. It has a national store network in Australia, and is expanding in New Zealand. The company also fairly recently acquired Plush. Between those two businesses, it had 107 stores in June 2023 and wants to grow this to at least 176 over time. That would be an increase of 64%.

It's also possible that Nick Scali could expand to other countries, which would open up another growth avenue for the company.

The business usually achieves an impressive return on equity (ROE) for shareholders and typically pays an attractive dividend yield as well.

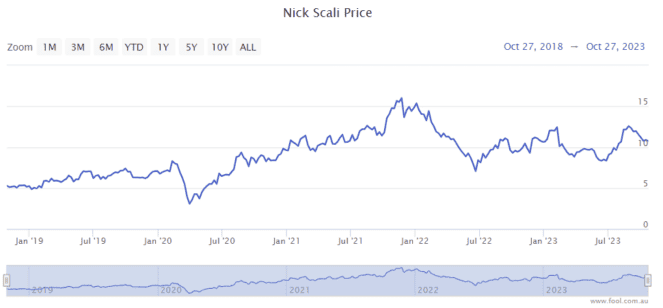

Over the last five years, the Nick Scali share price has risen 110%, as we can see in the chart below.

Tuas Ltd (ASX: TUA)

Tuas is an ASX telco share that was split out of TPG Telecom Ltd (ASX: TPG). It operates in Singapore and has David Teoh as the executive chair. As a reminder, under Teoh's leadership, TPG became a major competitor in the Australian telecommunications space. Tuas could also become, or is, worthy of being in a Warren Buffett stock portfolio.

The ASX share appears to be making excellent progress. At the end of FY21, it had 392,000 subscribers. At the end of FY22, subscribers had grown approximately 50% over the year to 587,000. In FY23, subscribers grew by another 40% to 819,000.

Tuas is leveraging existing infrastructure as it grows subscriber numbers, so new revenue can help profit margins. In FY23, revenue rose 50% to $86.1 million, while earnings before interest, tax, depreciation and amortisation (EBITDA) doubled to $31.1 million. It was also able to improve its average revenue per user (ARPU) from $9.19 to $9.37 per month.

The business is expecting more mobile subscriber growth in FY24, it's investing in its 5G network and is also working on completing its broadband rollout.

If it keeps scaling, the Singapore business could become quite profitable. There's also an opportunity for the company to expand into other Asian countries.

Since the start of 2023, the Tuas share price has risen more than 50%, as we can see on the chart below.