The Magellan Financial Group Ltd (ASX: MFG) share price is plunging on Wednesday again for all the wrong reasons after it revealed major leadership changes and an additional expense.

The funds management business announced that chief executive David George, who only started last year, will be leaving at the end of this year.

While a new chief is sought, chair Andrew Formica will fill in as executive chair.

Magellan shares are 1.23% down in early trade on Wednesday morning in response to the upheaval, after closing Tuesday at $6.53.

Formica said that the board determined it's "time to refocus".

"The board remains focused on the delivery of exceptional investment performance for our clients and are well positioned to continue to explore organic and inorganic growth opportunities."

CEO only lasted 16 months

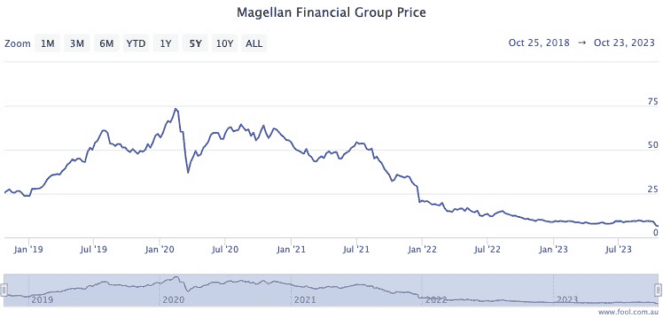

Magellan shares have dived 87% since July 2021 after a series of scandals struck the company.

Some of the lowlights included the mass outflow of funds from poor performance, the messy exit of well-known founder and former boss Hamish Douglass, and staff owing money from a geared employee share scheme.

George was brought in August 2022 from Future Fund, where he was deputy chief investment officer for public markets.

In the end he will have only lasted 16 months at Magellan as the stock price continued to spiral down to new 52-week lows.

Relieving pain for staff from freefalling Magellan shares

In a separate announcement on Wednesday morning, Magellan revealed it has taken steps to wipe the debts that staff owed from the share price plunging so much over the past two years.

"Our immediate focus is on ensuring we retain, attract, and appropriately incentivise our talent to drive performance excellence," said Formica.

"We are pleased to today announce that additional retention payments will be made to close out the Employee Share Purchase Plan Loan balances for the majority of staff by September 2025."

That move will cost Magellan $2.5 million for the current financial year.

Formica said that a new employee incentive model would be in place by 30 June next year.

Outgoing chief George himself bought $236,750 of shares last month, on which he's now lost about $75,000.