As an Australian, it makes you proud to see a local business grow from scratch and then start taking on the world.

But if you're also an investor, it's not just pride that swells from such a success story.

The Auscap team, in its latest memo to clients, highlighted one such ASX stock that it's backing for the long term:

Plenty more earnings growth to come

Carsales.Com Ltd (ASX: CAR) was established in 1997 to become the dominant vehicle classifieds site in Australia. According to the Auscap team, it now has more than four times the unique audience of its nearest rival.

So it's brought back pretty nice returns for investors over that time.

"Carsales has a long track record of very strong earnings growth and return on capital."

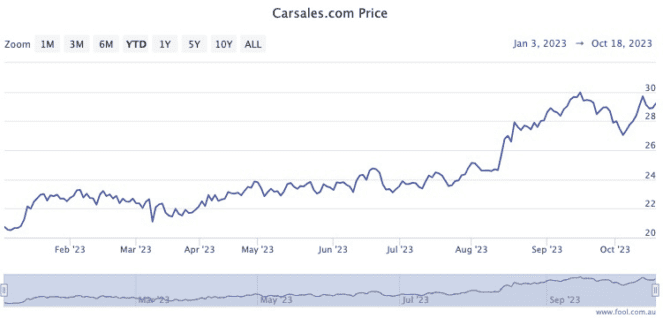

In fact, the share price has already rocketed in excess of 42.5% already this year.

But what's the deal for those who buy Carsales shares now?

For those newbies, the source of excitement is the company's rapidly expanding overseas ventures.

The Auscap analysts pointed out how Carsales fully owns Encar, which is the leading car classifieds in South Korea, and Trader Interactive over in the United States.

"[In] April 2023, Carsales has also increased its ownership of leading Brazilian automotive marketplace Webmotors from 30% to 70%."

Going gangbusters from San Francisco to Sao Paulo

After acquiring many overseas assets, the Auscap team points out Carsales now generates just under half of its earnings before interest, taxes, depreciation, and amortisation (EBITDA) outside of Australia.

That's what made the analysts pay a visit to the US and Brazil to check out how those businesses are running.

"After hearing from the Trader Interactive management team in San Francisco, we were impressed by the team's progress in aggressively rolling out Carsales' intellectual property in the very large US market."

Auscap was also impressed with what was happening over in Sao Paulo.

"We remain optimistic about Webmotors' growth prospects, premised on the national expansion opportunity, the runway for the 'Cockpit' dealer software offering, the opportunity of rolling out Carsales' yield enhancing products in Brazil, and Brazil's improving macroeconomic outlook."

Carsales.com is listed as a buy by nine out of 16 analysts that cover the stock in CMC Markets at the moment.