After an upsetting 2022 when a war started in Europe, it feels like it's all happening again.

The latest conflict in the Middle East has reminded investors that you never truly know what's coming.

The Gaza-Israel violence started just when the world thought it had enough of interest rate rises and that 2024 could see an economic recovery.

But now all bets are off.

The analysts at Alphinity are thus trying to determine exactly where we are in the economic cycle.

"Are we late or early in the economic cycle? While difficult to know for sure, we lean towards being late."

However, the team is warning investors from thinking the bottom is close.

"Large savings buffers, full employment and strong corporate balance sheets have all so far effectively absorbed the shock of sharply-higher rates, but that doesn't mean people are ready to further increase consumption meaningfully, or that corporates are looking to step up their capital expenditure intentions any time soon."

In the midst of this uncertainty and anxiety, the Alphinity team made a crucial sell and buy recently.

Swapping mining shares

Iron ore is a proxy for how healthy the global economy is, as it is a building block for infrastructure.

While previously Fortescue Metals Group Ltd (ASX: FMG) was Alphinity's investment in this sector, it changed its mind in recent weeks.

"We switched our position in Fortescue Metals into Rio Tinto Ltd (ASX: RIO)," Alphinity analysts stated in a memo to clients.

"Both companies remain intrinsically linked to the iron ore price in the short term but the numerous management changes at Fortescue as well as increased uncertainty about the capital allocation framework for the company's investment decisions in renewable energy projects has increased its company-specific risks."

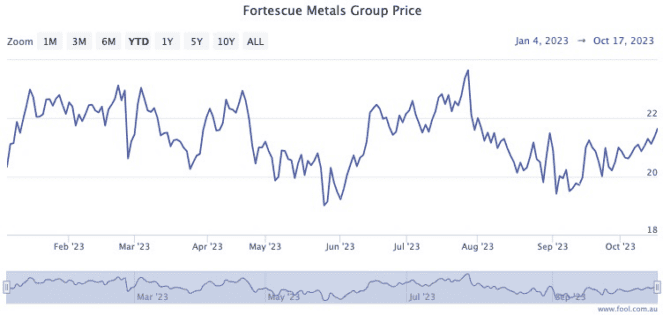

The management upheaval was indeed reflected in Fortescue's share price, sending it 18.25% lower from 26 July to 8 September.

The mining shares have since partially recovered to be trading 8.5% down.

The analysts acknowledge that founder and chair Andrew Forrest's drive to pivot the company into green energy is positive in the long run.

But they're not so sure of its investment value in the immediate future.

"While its ambitions in renewables are admirable, the share price consequences of unrealistic project assumptions have been on stark display in Europe this year."

It seems many of Alphinity's peers agree.

In a finance industry not known for handing out many cut recommendations, an overwhelming 10 out of 15 analysts surveyed on CMC Markets rate Fortescue as a sell.

Meanwhile, nine out of 14 analysts are rating Rio Tinto as a buy.