Investors are always warned to be careful, or even suspicious, of high dividend yields.

That's because lofty yields can easily be a trap, where a declining share price ends up cancelling out all the received distributions — or worse.

So when a professionally operated fund confesses it just bought an ASX dividend stock giving out a juicy 8% yield, it might be worth paying attention.

The experts at IML Equity Income Fund named one such pickup in a memo to clients, as well as two other beauties they bought recently:

'A high quality portfolio of property assets'

With 12 interest rate rises hitting the economy pretty hard, it's no wonder both the retail and real estate sectors have been struggling.

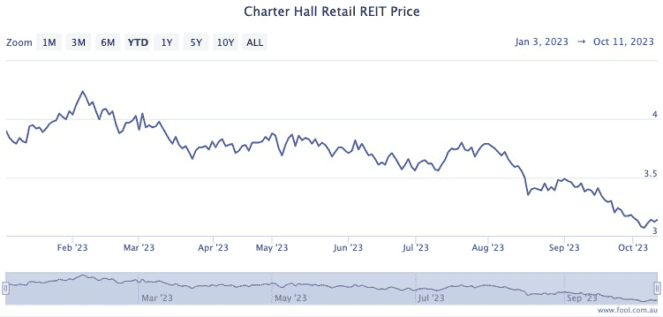

Perhaps that's why Charter Hall Retail REIT (ASX: CQR), which is a landlord for retail tenants, has seen its share price plunge 15.7% so far this year.

"Charter Hall Retail REIT holds a portfolio of neighbourhood shopping centres and petrol stations," read its memo.

"It was disappointing over [last] quarter, declining 13% as many real estate holdings were sold off on interest rate concerns."

For the IML team, the current dip presented it with a value buy.

"We retain strong conviction in CQR and added to it over the quarter.

"It has a high quality portfolio of property assets with low [vacancy] and strong growth and it is currently trading at a yield of around 8%."

According to CMC Markets, six out of 11 analysts currently rate Charter Hall Retail shares as a buy.

Two more dividend stocks going for cheap right now

The IML team also disclosed that it had bought Sonic Healthcare Ltd (ASX: SHL) and Steadfast Group Ltd (ASX: SDF).

Sonic pays out a fully franked dividend yield of 3.45% while Steadfast generates 2.65%, also fully franked.

They are also experiencing share price weakness, which the IML analysts took advantage of.

The Sonic Healthcare share price is now trading at 17.8% lower than what it was in mid-July. Steadfast Group shares are going for 8.8% down from its 20 June peak.