Some pretty important economic data will be released this week that could impact your ASX shares.

Here is a summary of the three biggest ones, according to eToro market analyst Josh Gilbert:

1. Reserve Bank board minutes

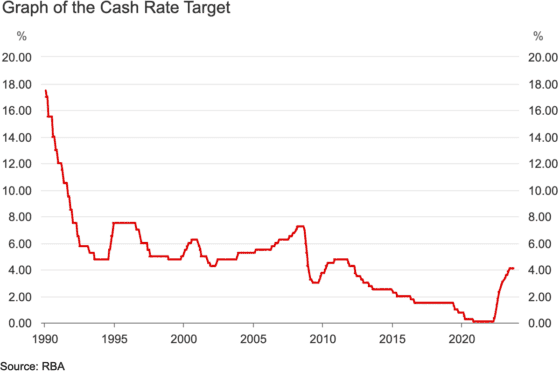

This month's Reserve Bank of Australia board minutes will be published on Monday, which will document the first meeting with governor Michele Bullock in charge.

With Bullock starting her era with a fourth consecutive interest rate pause, Gilbert reckons the minutes won't show a massive change in attitude from the central bank.

"RBA assistant governor Christopher Kent reaffirmed in an address to Bloomberg this week that some further tightening may be required, but he also stated that the lagging impact of this year's significant run of consecutive rate increases are still yet to be felt."

Gilbert noted another assistant governor, Chris Kent, saying elevated home loan repayments are finally starting to force households to spend less.

"Essentially, the RBA leadership team sees inflation heading back towards target levels, suggesting a bias for keeping rates on hold for the time being."

2. Australian unemployment figures

The unemployment rate is a huge indicator of the health of the economy, so Thursday's data will help the RBA understand whether its rate rises are biting.

Last month the rate hit 3.7% so, according to Gilbert, anything above that will encourage the RBA to not raise rates for "the foreseeable future".

"Conversely, a drop in unemployment gives the RBA a sensible reason to hike again, particularly if the Q3 CPI is hotter than expected."

3. China gross domestic product

Investors in ASX shares need to keep a close eye on the economic growth data for Australia's largest trading partner, to be released Wednesday.

The second quarter saw 6.3% growth in the Chinese GDP. That's expected to slow to 4.4% this time, according to Gilbert, which is absolutely anaemic by Chinese standards.

"China originally set a GDP growth target of around 5% for the year and this will likely remain their focus.

"However, we've seen a very cautious approach to launching any substantial stimulus measures, even despite mounting pressure from investors and key industry."

The worry for Chinese authorities is that consumers would keep any stimulus as savings, rather than spending it.

But Gilbert reckons it's getting to a point where they need to risk that.

"With the country's GDP continuing to slide backwards and growth targets unwavering, we may see more significant economic measures announced before year's end."