When a S&P/ASX 200 Index (ASX: XJO) stock that's often listed as a staple by experts is suffering from a short-term dip, it's only right to consider adding it to one's portfolio.

And that's precisely the situation we find with Lottery Corporation Ltd (ASX: TLC) at the moment.

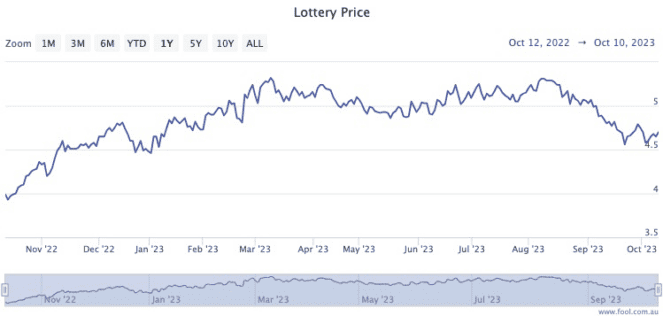

The share price has plunged more than 11% since the August reporting season.

Fairmont Equities managing director Michael Gable thus analysed it this week to see whether it's worth buying right now:

Why did Lottery Corp shares tumble?

The reason for the plummeting stock price was recent underperformance in the lotteries business.

Just like its customers, luck had much to do with this.

"Unfavourable jackpot outcomes had a meaningful impact on turnover for the lotteries division," said Gable on the Fairmont blog.

"Powerball tracked close to the statistical model. However, Oz Lotto experienced a highly unfavourable 1-in-20-year jackpot run."

And as the lotteries business brings in 85% of earnings before interest, taxes, depreciation, and amortisation (EBITDA), the Keno arm was never in a position to offset those losses.

Can the stock price recover?

However, the simple fact remains that Lottery Corporation holds lottery licences in all Australian states and territories except for Western Australia.

And since synthetic lotteries were banned in Australia a few years ago, those licences give Lottery Corp a monopoly in all those markets.

According to Gable, the company's margins are set to expand even though wage and marketing inflation will eat into earnings.

"Despite the expectations for higher costs, EBITDA margin expansion at a group level is still expected in FY24/25 from two avenues: an earnings boost from increased retailer commissions and the resumption of digital penetration."

For these reasons, Gable expects the shares to climb again.

"[Negative] sentiment is likely to reverse as the market begins to look through the FY23 result and instead focus on several strong fundamental drivers," he said.

"These include the normalisation of the jackpot cycle in FY24 and the potential for margin expansion."

A sweetener is a fully franked 3% dividend yield.

"It… seems that we have a significant low for now. TLC, therefore, looks like a buy at current levels."