Fancy buying a S&P/ASX 200 Index (ASX: XJO) stock paying out fat dividends while enjoying global tailwinds?

Not interested yet?

What if you could buy those shares at a 10% discount?

Does it now sound like a bargain stock?

I have a candidate for you:

What is Viva Energy?

Viva Energy Group Ltd (ASX: VEA) is in the fuel business, operating a oil refinery in Geelong and a large network of petrol stations around Australia.

Motorists would likely be familiar with the company through its Shell, Coles Express and Liberty service stations.

It's not the worst time to be selling energy and fuel at the moment.

Russia's invasion of Ukraine last year sent energy prices shooting up, then this year Saudi Arabia and Russia have been intentionally lowering crude oil production to keep the market buoyant.

And the last week has seen horrific violence in Israel and Gaza, threatening to disrupt a part of the globe that's critical for international energy supplies.

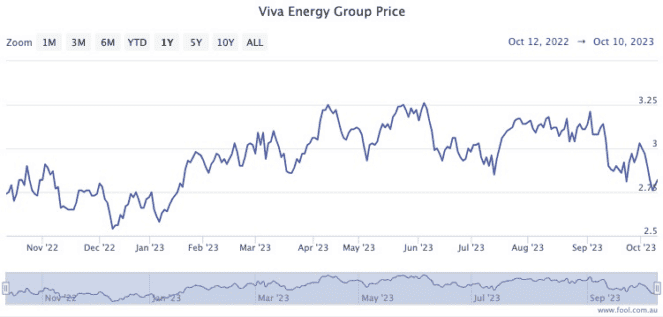

The Viva share price is heavily discounted right now

Despite these tailwinds, Viva shares are down 9.7% since 4 September.

This might be because central banks have been signalling retaining higher interest rates for a longer period to combat still-stubborn inflation.

This would leave the global economy depressed for an extended period, and would decrease demand for fuels.

Also, major shareholder Vitol sold off some of its holdings, although it has publicly assured that it is with Viva for the long run.

So could this be a bargain?

Why Viva Energy could boom in the coming years

My opinion is that Viva Energy has a fighting chance to, at a minimum, maintain its valuation while paying out a sweet 9.5% dividend yield.

With a dominant position in the Australian domestic fuel retail industry, it can potentially do far better than that in the coming years.

RBC Capital this week agreed with this bullishness, upgrading its rating for Viva to outperform with a 19% upside on just a 12-month horizon.

In August, Red Leaf Securities chief John Athanasiou pointed out another possible catalyst for Viva Energy in the coming months.

"The company is working towards completing the acquisition of the OTR Group by the end of 2023," he said on The Bull.

"The OTR Group generates much more revenue than Coles Express. Viva offers impressive management."

The OTR deal is currently awaiting approval from the Australian Competition and Consumer Commission.