Shareholders for a $15 billion ASX company are cheering Tuesday after the competition watchdog gave the green light for it to be bought out by overseas suitors.

The Australian Competition and Consumer Commission on Tuesday morning granted authorisation for all the shares in Origin Energy Ltd (ASX: ORG) to be sold to a group led by Canadian giant Brookfield Corp (NYSE: BN) and private equity-backed MidOcean Energy.

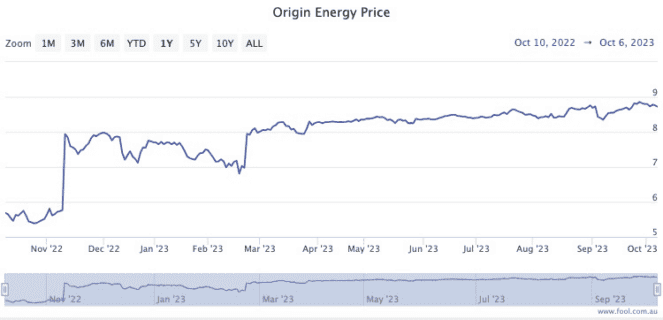

Origin shares shot up more than 5% in early trade on Tuesday.

The deal will actually consist of two separate transactions. A Brookfield-led consortium will acquire Origin's electricity generation and energy retail arms, while MidOcean will take over Origin's upstream gas interests.

The watchdog ruled that the takeover failed the competition test but passed the public benefit criteria.

"The ACCC considers that the acquisition will likely result in an accelerated roll-out of renewable energy generation, leading to a more rapid reduction in Australia's greenhouse gas emissions," said ACCC chair Gina Cass-Gottlieb.

"The Brookfield Global Transition Fund has been specifically established to focus on the transition to renewable energy. Its decision to buy Origin, Australia's fourth largest emitter of greenhouse gases, is driven by a strong imperative and commercial incentive to lower emissions quickly."

Still more water to go under the bridge

The acquisition is still awaiting approval from the Foreign Investment Review Board, and details about the buyout are yet to be revealed to shareholders.

Media reports suggest the buyout will value Origin at around $18.7 billion, giving shareholders around $8.91 per share.

The energy stock closed Monday at $8.73.

Despite the downsides for competition, the ACCC ruled that Origin and Brookfield would be able to accelerate Australia's transition to renewable energy sources faster with the transaction.

"The acquisition includes a large retail customer base to support the investment and is being made by a fund which has a specific mandate to invest in the renewable energy transition and which brings significant global renewable energy investment experience," said Cass-Gottlieb.

"Brookfield's reputation and its commitment to progress the proposed roll-out will be subject to public scrutiny via the reporting obligations in the undertaking provided to the ACCC."

Origin shares have gained more than 55% over the past 12 months.