The PEXA Group Ltd (ASX: PXA) share price fell 8.44% to a new 52-week low of $9.98 on Friday.

Pexa shares are currently trading for $10.04, down 7.9% at the time of writing.

The company behind the popular online property exchange platform has made some ASX investors nervous this week.

Yesterday, the company announced its intention to acquire a loss-making UK-based business.

The Pexa share price closed the session yesterday down 1.67% to $10.90.

Pexa investors mulling acquisition news

Judging by today's much larger fall in the Pexa share price, it seems investors are not so pleased with the deal.

PEXA is buying Smoove PLC (LSE: SMV), a conveyancing technology provider, for $58.6 million.

If Smoove shareholders approve the deal, then Pexa expects it to complete in the current quarter.

As my Fool colleague James reports, several brokers have responded by reducing their earnings estimates for the Pexa Group.

Pexa says the acquisition will enable faster expansion into the UK market.

For starters, it will give Pexa access to more than 75 conveyancing firms already using Smoove.

The company will also get access to about 2,100 other companies through Smoove's work in arranging panels for UK lenders.

Pexa released an investor presentation yesterday and provided more commentary on the deal today.

What did management say?

CEO and Managing Director Glenn King said:

The acquisition is aligned with PEXA Group's strategy of enhancing and leveraging our property exchange know-how to deliver growth from different markets, including in other Torrens title jurisdictions, starting with the UK.

The acquisition will allow us to build additional scale and depth in the UK market, enabling the PEXA product suite to reach more customers, whilst streamlining and improving the UK property transaction experience.

King points out that the sale and purchase market in the UK is substantially larger than Australia's market.

The refinance market is only slightly larger, however. UK customers are generally reluctant to refinance because the process is lengthy and stressful.

King describes the UK settlement process as "highly challenged". Therefore, one of Pexa's key competitive advantages is being able to make the conveyancing process faster and smoother.

King says:

Relative to other key Torrens markets, transaction fail rates are unacceptably high and the time to complete transactions is overly long.

This is key to the benefits that PEXA creates for customers and stakeholders.

Pexa share price snapshot

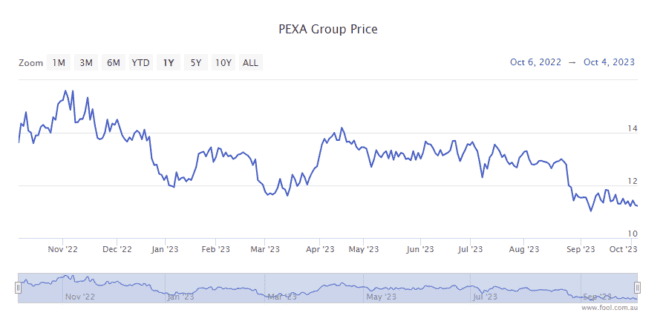

The Pexa share price is down 14.3% in the year to date and down more than 30% over the past 12 months.