The Novonix Ltd (ASX: NVX) share price is going gangbusters on Thursday after the company gave its latest briefing to the market.

The stock was up 2% at the time of writing on early Thursday afternoon.

The US battery materials and technology producer's update released before ASX open didn't contain any blockbuster announcements.

However, what probably piqued investor interest was a hint that the loss-making startup has mapped out a path to profitability.

'Improved economics'

Since interest rates have risen steeply in both Australia and the US over the past 18 months, making more money than spending it has been a renewed focus for stock investors.

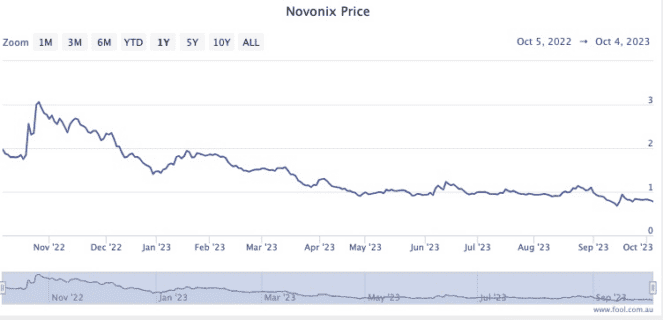

Thus Novonix shares have plunged a horrendous 92.4% since January 2022.

According to the company's update, its Riverside processing facility in Chattanooga, Tennessee is showing "improved economics".

Novonix is betting that this scaling, combined with government tax credits and assistance from the US Inflation Reduction Act, will expedite its journey to a positive cash flow.

Insiders putting their money where their mouths are

In a great sign for investors, insiders have been buying up Novonix shares in recent times.

The Motley Fool reported last week that three directors in total bought $700,000 worth of shares with their own money in September.

"Chair and non-executive director Robert Natter purchased 380,000 Novonix shares at an average price of 78 cents per share on-market on 15 September," said The Motley Fool's Bronwyn Allen.

"Non-executive director Andrew Liveris bought 360,000 shares at an average price of 82.02 cents on-market on 19 September. Deputy chair and non-executive director Tony Bellas raised his indirect holdings by 116,959 shares on-market at an average price of 86.9951 apiece on 19 September."

The $360 million company is not covered by any analyst surveyed on CMC Markets.