Many readers of The Motley Fool would be aware the past couple of years have not been pleasant for most technology stocks.

Back at the end of 2021, the threat of inflation reared its head and the market turned away from high-growth equities out of fear that interest rates would rise.

Then all throughout 2022 rates did actually rise, killing the bullish buzz that technology enjoyed for a good decade before that.

While this year has seen some recovery, much of that has been driven by the giant, market-dominant tech companies.

And besides, September poured cold water on the entire sector, with the S&P/ASX All Technology Index (ASX: XTX) losing a painful 5.1%.

But with inflation cooling down and interest rate hikes potentially coming to an end soon, are there any tech gems out there that you could pounce on right now?

Shaw and Partners portfolio manager James Gerrish had one idea:

'Shares have been surprisingly strong'

Audinate Group Ltd (ASX: AD8) is a developer of audio-visual networking technology.

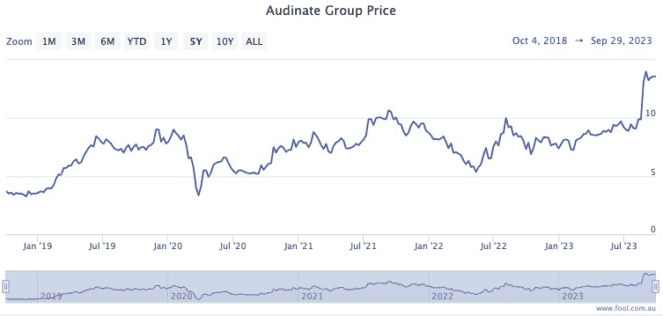

Certainly, the stock was not immune from the inflation-fear sell-off last year, halving its value from December 2021 to May 2022.

But since then, the Australian company has defied the odds to attract investors like flies.

Check out these figures: the Audinate share price has rocketed 141% since May last year, 86% over the past 12 months, and 71% so far this year.

As amazing as that run has been, Gerrish is convinced there is more to come, declaring his team "remains long and bullish".

A share purchase plan (SPP) closed this week, and there was no hesitation in participating.

"Despite the recent volatility in markets and the capital raise and lingering SPP, Audinate shares have been surprisingly strong, reaffirming our bullish position on the company," said Gerrish in his Market Matters newsletter.

"We are looking to top up our holding in order not to dilute our position in the company. As such, we are participating in the SPP with a 0.5% allocation in the portfolio."

The Audinate share price did sink 10% on the morning of 8 September, but that was due to the fear of dilution from the just-announced capital raising.

For long-term investors, that could present a fleeting opportunity to buy the dip.

While coverage is sparse, Gerrish's peers generally agree with his bullishness.

CMC Markets currently shows five out of six analysts recommending Audinate as a strong buy.