Thankfully new Reserve Bank of Australia governor Michele Bullock's first interest rate decision on Tuesday afternoon was to leave it as is.

However, is this the unnerving silence before more pain?

There seem to be two camps of economists.

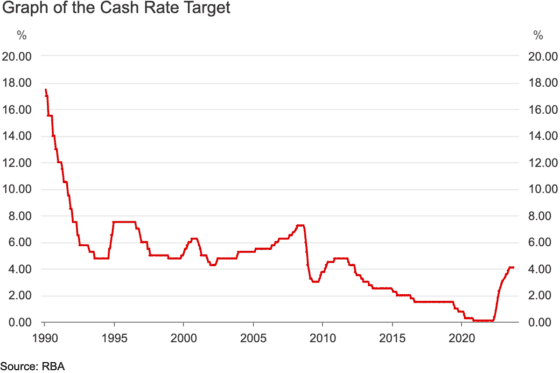

One group believes the impact of 12 rate rises over 14 months is still cascading out through the economy, and that any more hikes could be overkill.

The other is looking at the current inflation figure. While it has come down from the end of last year, it is still stubbornly high, meaning that they reckon the RBA still needs to come in with some killer blows.

Investors, consumers, and businesses all want to put this rate hike cycle behind them. But which way will the RBA go from here?

'Markets see the possibility of another rate hike'

RMIT University economics associate professor Bilgehan Karabay is warning everyone that there could be more agony for Australians.

The tight housing rental market, for one, will keep pushing inflation higher.

"Markets see the possibility of another rate hike in the US until the end of this year," said Karabay.

"Other economies, including Australia, also face the same risk. The Australian dollar recently depreciated against the US dollar, which could create further inflationary pressures through our imports."

A survey of economic experts by comparison site Finder found 48% thought interest rates have already peaked, while 42% are forecasting more rises to come.

Regardless, it's a tough outlook for the country, with the panel on average declaring that there is a 32% chance of a recession hitting Australia.

Moody's Analytics economist Harry Murphy Cruise said "there are plenty of pain points" for Aussies.

"Rents and utility prices are heading skyward, and rising services inflation continues to dampen the 'good' news – quickly falling goods inflation."

According to Corinna Economic Advisory economist Saul Eslake, underlying inflation remains too high for the RBA to ignore.

"If the RBA were to do anything over the next 6 months it would be to raise rates again — on a "least regrets" basis similar to that used by the ECB at its last meeting — but I think the odds of that are less than 50%."