Suncorp Group Ltd (ASX: SUN) stock is flipping from small losses to small gains on Tuesday.

At time of writing, shares in the S&P/ASX 200 Index (ASX: XJO) banking and insurance giant – whose banking arm remains an ANZ Group Holdings Ltd (ASX: ANZ) takeover target – are down 0.1% at $14.05 apiece, having earlier been up 0.2%.

It's not just Suncorp stock that's sliding right now, though.

The ANZ share price is down 0.3%, and the ASX 200 is down 0.5% at this same time.

Here's what ASX 200 investors are considering today.

What's happening with the ANZ takeover target?

In an announcement this morning unlikely to have a material impact on Suncorp stock, the ASX 200 company reported that Suncorp Bank CEO, Clive van Horen, will step down from his role on 24 December.

Commenting on the departure, Suncorp Group CEO Steve Johnston said:

Clive and his team have done an exceptional job in simplifying the Bank and growing our home and business lending portfolios, particularly in what has been a complex and highly competitive market. They've also made great strides in delivering improved experiences for our customers as well as brokers.

Van Horen, who has held the top banking spot since August 2020, said, "Suncorp Bank is a strong business with great people and customers and has many opportunities ahead of it."

As for ANZ's ongoing efforts to acquire the banking segment of Suncorp stock, van Horen added, "I continue to believe that the proposed sale of Suncorp Bank to ANZ is in the best interests of the Bank's customers, people and the broader community."

Johnston expressed similar sentiment on the proposed takeover – which has been blocked by the Australian Competition and Consumer Commission (ACCC) over competition concerns –when Suncorp reported its FY 2023 results in August.

"Suncorp will support ANZ through the next step of the merger authorisation process as it relates to the sale of Suncorp Bank, being a referral of the ACCC's recent decision not to approve the transaction to the Australian Competition Tribunal for review," he said at the time.

Suncorp stock snapshot

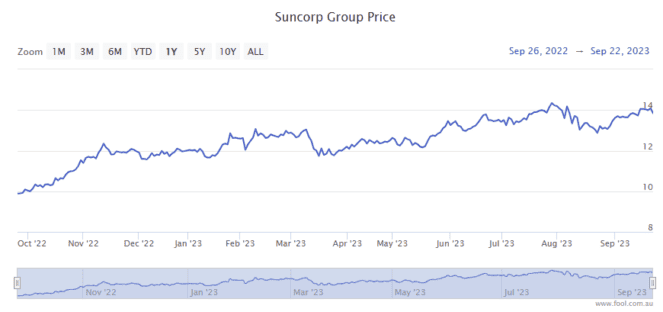

It's been a very strong year for Suncorp stock, with shares up 41% over 12 months.