The Fortescue Metals Group Ltd (ASX: FMG) share price fell 1.45% to an intraday low of $20.89 today.

The ASX 200 iron ore giant finished the day trading for $20.97, down 1.08%.

Other ASX mining shares also closed lower today.

BHP Group Ltd (ASX: BHP) shares ended the session at $45.10 apiece, down 1.44%, while Rio Tinto Ltd (ASX: RIO) shares finished 0.65% lower at $118.54 each.

This follows a fall in the spot price for iron ore overnight. It fell 1% to US$121.75 a tonne.

Mining and materials was the worst performer among the 11 market sectors today.

The S&P/ASX 200 Materials (ASX: XMJ) closed 0.77% lower on Tuesday.

By comparison, the S&P/ASX 200 Index (ASX: XJO) lost 0.47% today.

Fortescue share price goes hand in hand with iron ore price

The Fortescue share price tracks the iron ore price much more closely than the other major iron ore shares.

This is because Fortescue is a pure-play iron ore miner.

Soon enough, it won't be, once the company starts making money from its hydrogen and other green energy businesses within its Fortescue Future Industries division.

But for now, it's a true blue iron ore pure play.

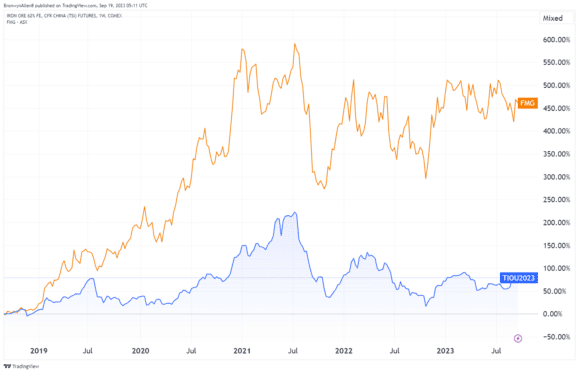

Take a look at this historical chart showing how the Fortescue share price has moved with the iron ore price over the past five years.

As you can see, the line patterns are very similar.

With this connection in mind, we note that top broker Goldman Sachs has released a note outlining its forecast for the iron ore price over the next four years.

As my colleague James reports, Goldman expects a significant pullback in the iron ore price in the final quarter of 2023.

It forecasts an average price over the quarter of US$90 a tonne, which is more than a 25% drop from today's level.

Goldman forecasts an average price of US$93 a tonne in 2024, US$85 a tonne in 2025, and US$84 a tonne in 2026.

Given this, it's possible we may see a fall in the Fortescue share price alongside the iron ore price.

Moody's affirms stable rating on Fortescue

Meantime, ratings agency Moody's has affirmed its stable outlook rating on the ASX 200 mining giant.

In a statement, Moody's affirmed the Ba1 corporate family rating (CFR) of Fortescue Metals Group and maintained its stable outlook.

Moody's also affirmed the Ba1-backed senior unsecured ratings of FMG Resources, a wholly-owned financing subsidiary.

Moody's said:

The stable outlook reflects Moody's expectation for continued strong earnings and cash flow in the current iron ore price environment, and that credit metrics will be maintained comfortably within tolerance levels for the rating over the next 12-18 months, even as Fortescue funds its various growth initiatives.

The agency noted that turnover of senior management was a "credit negative" for Fortescue.

As we reported, Fortescue Metals CEO Fiona Hick and CFO Christine Morris quit last month, as did a non-executive director of Fortescue Future Industries (FFI), Guy Debelle.

The agency commented:

Moody's considers elevated turnover at the executive levels over the past several years as credit negative, with the potential to impact strategy and operations, which may have implications on the group's balance sheet, financing and capital structure.

The agency added that Fortescue's "board structure and concentrated ownership by its chairman (approximately 37 per cent) increase governance risks".

According to the Australian Financial Review (AFR), Moody's remains impressed by Fortescue's ability to grow its iron ore sales.

However, it expects the balance sheet to come under pressure given the miner intends to make at least five final investment decisions on clean energy projects before the end of 2023.

Moody's said:

The ultimate projects selected, as well as the scale and funding requirements for the projects remains uncertain. However, Moody's expects that these projects could materially increase the company's capital expenditure requirements and increase debt levels over the next several years.

Are Fortescue shares a buy at today's price?

Braden Gardiner from Tradethestructure reckons Fortescue shares are a sell.

Gardiner told The Bull:

The share price has been trending down since closing at $23.73 on July 26.

Investors are concerned about Chinese growth levels. In my view, the technical outlook remains negative, and I believe the share price will continue to drift lower at this stage of the cycle.

Investors may want to consider trimming their exposure.

According to the Westpac trading platform, there are 15 analysts covering Fortescue shares.

Nine out of the 15 analysts say Fortescue shares are a strong sell.

Three say it's a moderate sell, two say hold, and one says the ASX 200 iron ore miner is a strong buy.