Telstra Group Ltd (ASX: TLS) shares have underperformed the benchmark index during the last 12 months by 2.3%. However, the disappointing comparison really only manifested following the telecommunications giant's FY23 results, which were met with disappointment.

Since hitting a 52-week high of $4.46 in June, the Telstra share price has retreated 13% to its present-day $3.88 level. The steep retraction could offer an enticing proposition to buy (more) shares in one of Australia's largest and most recognised brands to those who are interested.

Before those Telstra shares call your portfolio a home, it might be worth inspecting the company's balance sheet. No one wants to go on a blind date with a broken balance sheet. Knowing the damage — or strength — is better ahead of time.

Should investors be worried about the balance sheet?

As of last week, Australia is now in a 'per capita recession'. In short, this means the country's gross domestic product (GDP) growth declined for two consecutive quarters when adjusted for population growth.

Adding to the concern, 70% of respondents in a recent survey expected a bonafide recession in the next 12 months. Those surveyed included insolvency professionals, turnaround advisors, lawyers, and lenders.

As such, balance sheet health could be of its highest importance since Australia's last recession, which occurred 31 years ago.

So, how is Telstra financially situated?

At the end of June 2023, the blue-chip business reported $955 million in cash and equivalents, slightly lower than the previous year. Meanwhile, debt ticked higher year on year to $12,521 million. When these numbers are combined, we come away with a net debt position of $11,566 million.

However, it's probably more helpful (and insightful) if we analyse some common balance sheet ratios to understand how an investment in Telstra shares today compares to any other time during the past decade.

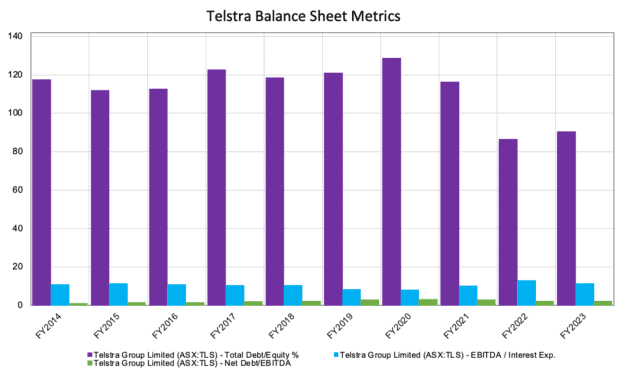

Three key financial ratios are presented in the chart above. These are the percentage of debt-to-equity (purple), the interest cover ratio (blue), and the debt servicing ratio (green).

The lower the purple and green bars, the stronger the balance sheet. In contrast, the higher the blue bar (interest coverage), the bigger the buffer Telstra has to meet its interest payments on debts.

Notably, Telstra is in a better financial position as of June 2023 on all three metrics compared to its averages over the past decade.

Will lower interest rates benefit Telstra shares?

Interest rates are at their highest levels since 2012, making debt an expensive way of funding operations.

In the 2023 financial year, Telstra coughed up $570 million to pay interest on its debts. To put that into perspective, it equates to nearly 30% of the company's net profits after tax (NPAT) in FY23. Comparatively, the telco earned a measly $37 million in interest on its smaller cash mound.

Given Telstra's significant use of debt, a weakening economy might end up having a silver lining for the network provider. The likelihood of rate cuts increases as the economy weakens. This means Telstra shares could possibly benefit from reduced interest expenses.