Investors in ASX shares, businesses, and everyday Australians will all hold their breaths on Tuesday afternoon.

That's because at 2:30pm, the Reserve Bank of Australia will hand down its latest interest rate decision.

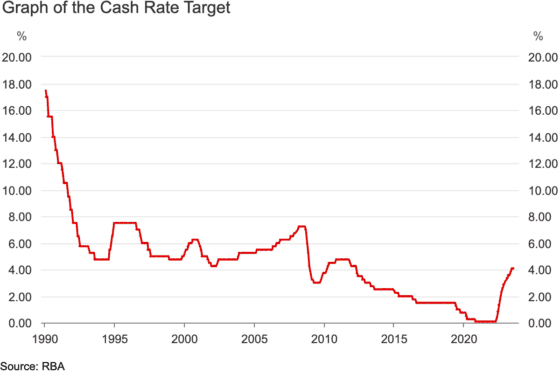

An increase to further quell inflation would place additional pressure on consumers and businesses, who are already dealing with 12 rises over 14 months in 2022 and 2023.

A hold would provide everyone, including ASX shares, with massive confidence.

So which way will the rate head?

Most experts think RBA will hold

According to last week's survey conducted by comparison site Finder, a massive 37 out of 38 prominent economists and experts reckon the RBA will leave the cash rate alone on Tuesday.

Perhaps more importantly, two-thirds of those gurus are tipping that Australia has seen the last of the rate rises.

Macquarie University economics professor Jeffrey Sheen is one of those who think the next move for the RBA could be cutting rates, not raising them.

"With inflation slowly trending downwards, and provided there are no major unexpected shocks, the RBA has now done enough tightening to achieve its inflation target in a reasonable time.

"There is a significant risk of exported deflation and stagnation from China in the next 6 months, which may require the RBA to ease monetary policy."

But what about later?

Although most think interest rates will not change this week, a significant number of the surveyed experts are wary of increases in the coming months.

University of Sydney economics associate professor Mark Melatos is tipping a hold on Tuesday but forecasting that eventually the current 4.1% cash rate would peak at 5.1%.

That could mean a further four increases from the RBA.

"Inflation remains significantly above the RBA's target band.

"While it appears that the labour market might be starting to slacken, the RBA is still in catch-up mode with respect to matching their cash rate settings to the inflation reality."

IG Markets analyst Tony Sycamore's prediction is less dramatic.

"I am looking for the RBA to hike rates one more time before the year as it fine-tunes its monetary policy settings to ensure inflation returns to target within a reasonable time frame."