Woolworths Group Ltd (ASX: WOW) is certainly one of the ASX's most famous shares. Not only is Woolworths one of the largest companies in Australia, but it is one that most of us probably engage with on a fairly regular basis. After all, we are talking about the market leader in the supermarket and grocery space in the country.

Just as Woolworths is well embedded in the Australian consumer landscape, so too are Woolworths shares in the portfolios of the average ASX investor. Woolies is a classic blue-chip, consumer staples share with a long history of delivering substantial returns to ASX investors. And a large part of those returns has come from dividend payments.

To be sure, Woolworths also has a long history of providing its investors with fully franked dividends.

But it hasn't been the most consistent one.

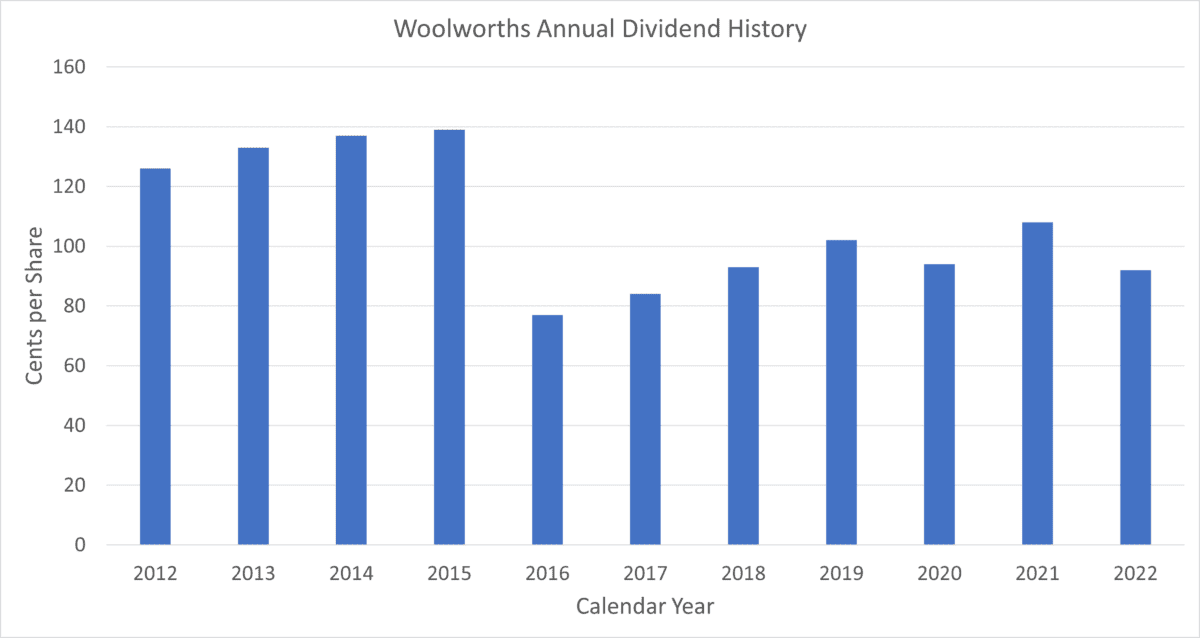

Just take a look at the company's dividend payout history over the past ten years:

To be fair, there is one large caveat worth making here. Woolworths spun out the $10.7 billion Endeavour Group Ltd (ASX: EDV) back in June 2021. The Endeavour business would have been a significant source of earnings and, thus, dividends for Woolworths.

This explains the payout drop we've seen since then as Endeavour left the Woolworths nest for the ASX and started paying its own dividends.

But still, it isn't easy to overlook the fact that Woolworths' dividend history has been, well, anything but consistent.

But the past is the past. So what might the future hold for Woolworths shares and their dividends?

When will Woolworths shares start paying consistent dividends?

Well, 2023 is off to a good start for Woolworths' income investors. April saw the company fork out its 2023 interim dividend. This payment came in at 46 cents per share, fully franked. That's a pleasing 17.95% rise over 2022's corresponding payment of 39 cents per share.

One ASX broker is predicting that the rises will keep on coming too.

As we covered earlier this month, Goldman Sachs has Woolworths shares on its conviction buy list at present, with a 12-month share price target of $42.80. That would represent an upside of almost 9% from the $38.83 share price Woolworths closed at yesterday.

But crucially for dividend investors, Goldman is pencilling in a 60 cent per share final dividend later this year. If that proves accurate, it would be a 13.2% rise over last year's final dividend of 53 cents per share.

Goldman is also forecasting that Woolworths will be able to pay out a total of $1.15 per share in dividends for FY2024, up again from its FY2023 estimate of $1.06 per share in dividend payments.

If all of these predictions indeed come to pass, it would certainly help Woolworths to claim a far more consistent dividend policy than what has been on display over the past few years.

It might even get to a place where its dividends resemble the perfect staircase that its arch-rival Coles Group Ltd (ASX: COL) can boast of.

But we'll just have to wait and see what happens. In the meantime, the current Woolworths share price gives this ASX 200 blue chip share a trailing dividend yield of 2.55%.