Those who have held Wesfarmers Ltd (ASX: WES) shares over many years have benefitted from the conglomerate's expertise in acquiring, managing, and spinning off Australian businesses.

In recent years, the ASX blue-chip company has added Beaumont Tiles and former ASX-listee Australian Pharmaceutical Industries to its arsenal. Entering a binding deed on 26 June, Silk Laser Australia Ltd (ASX: SLA) looks set to possibly join the Wesfarmers pack.

However, rumour has it there could be another listed company already in Wesfarmers' sights.

Which ASX 200 member could be on the menu?

A week ago, Incitec Pivot Limited (ASX: IPL) addressed speculation that it was contemplating the sale of its fertilisers business. The company confirmed it had fielded 'a number' of approaches for its plant-powering division.

According to reporting by The Australian, the ever-sprawling Wesfarmers could be one of those approaches. Based on 'talk in the market', the retail powerhouse may have reached out to Incitec not too long ago.

With no word from Incitec, no formal deal has yet materialised. Though it is believed that three parties have kicked the tyres.

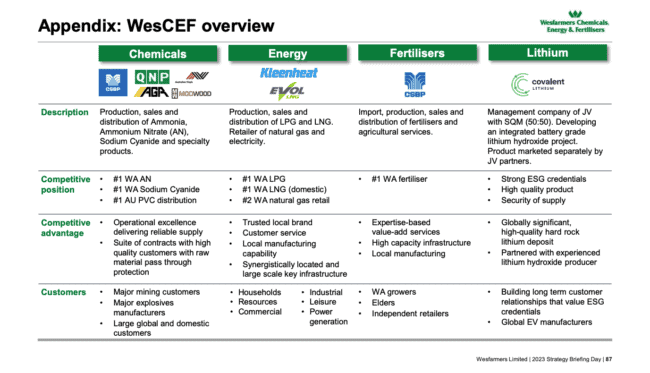

Given the nature of Incitec's fertiliser business, it would make sense for the WesCEF division of Wesfarmers to get involved. As it stands, WesCEF already produces ammonia and ammonia nitrate, in addition to selling fertiliser. Currently, the Kwinana-based CSBP is its cornerstone operation, as depicted above.

An acquisition of Incitec Pivot Fertilisers would extend WesCEF's dominance across the east coast.

Could another deal jeopardise Wesfarmers' shares?

Too much inorganic growth can be concerning. With several recent acquisitions under the belt, could another create a predicament for Wesfarmers?

Fortunately, the company has not diluted its shareholders to fund recent deals. Since 2017, the total number of shares outstanding has remained steady at 1.134 billion. Though, this would mean the balance sheet has done the heavy lifting.

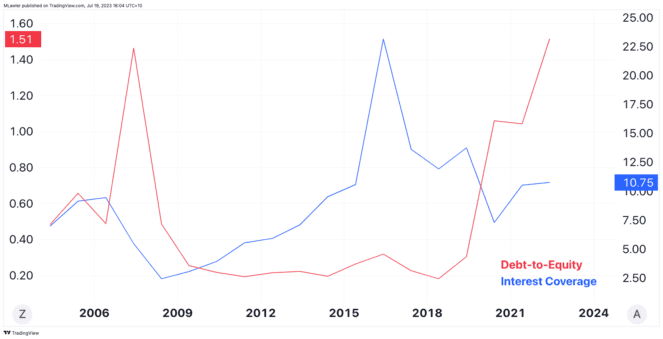

The past couple of years have seen cash dwindle while debts rise. At the end of 2022, net debt stood at $4.41 billion, increasing from $2.73 billion the year prior.

Despite the balance sheet deterioration, debt remains well covered by operating cash flows. Moreover, the company's interest coverage ratio of nearly 11 marks an improvement over earlier years, as pictured above.

The Wesfarmers share price is up 8.4% since the beginning of the year.