Historically, companies that pay dividends outperform their non-dividend-paying counterparts on a total return basis. Then, the task is to identify the ASX shares that balance dividend yield and growth.

High yields might entice an income investor, but that may not necessarily be the best choice for long-term wealth creation. Get too greedy, and a value trap might consume more cash than it gives.

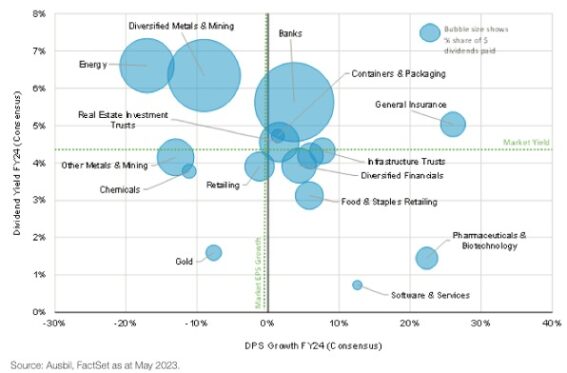

Of course, you could opt for the benchmark, investing in the S&P/ASX 200 Index (ASX: XJO). The diversified, 'low-risk' option is expected to generate a dividend yield of 4.4% this year and the next.

However, a few sectors may deliver superior passive flows for their investors.

Finding the sweet spot within ASX dividend returns

A common pitfall for dividend investors is gravitating toward ASX shares with the highest yield, like moths to a flame. The irresistible allure of potentially pocketing 8%, 9%, 10%, or even more in a single year (passively!) can be akin to kryptonite for those seeking to build wealth.

That being said, providing a high yield isn't a dealbreaker in and of itself. What matters is how sustainable the company's dividends are and whether it can maintain or even grow them in the future. It's that old adage of consistency beating intensity.

So, say we're not content with the 4.4% yield expected from the broader market — where else might we look? According to consensus estimates, some pockets of the ASX market could prove more lucrative.

As shown in the data above, analysts forecast several ASX sectors to deliver above-market dividends in FY24. These include banks, general insurance providers, real estate investment trusts (REITS), and containers and packaging companies.

One might dub this the 'Goldilocks zone' for dividends — providing a higher and faster-growing yield than the benchmark. The highest dividend per share FY24 growth forecast of the lot, general insurance, follows continued premium increases.

ASX shares in this industry currently paying a dividend include:

- QBE Insurance Group Ltd (ASX: QBE) – 2.51% yield

- Suncorp Group Ltd (ASX: SUN) – 4.5% yield

- Insurance Australia Group Ltd (ASX: IAG) – 1.92% yield

Meanwhile, the forecasts place ASX gold shares at the opposite end of the dividend spectrum.

Tread carefully

Before creating a portfolio solely packed full of banks and insurance shares, it's important to remember that wealth is created over decades, not one or two years.

The above chart provides a forecast for dividends from various ASX sectors for FY24. However, the placement of these sectors can ebb and flow over time. I would wager a large sum of money that the same chart looks recognisably different 10 years from now.

As Ausbil Dividend Income Fund portfolio manager Michael Price mentioned in a recent release, "Good dividend payers today may not be the good dividend payers in the future." That's why a diversified portfolio can provide passive income protection.

Additionally, don't forget that individual ASX shares are susceptible to their own risks.

For example, diversified financials, as a sector, are forecast to grow dividends at a greater rate than the market. However, analysts are now wary that Medibank Private Ltd (ASX: MPL) could taper its dividends after the prudential regulator ordered $250 million to be put aside.