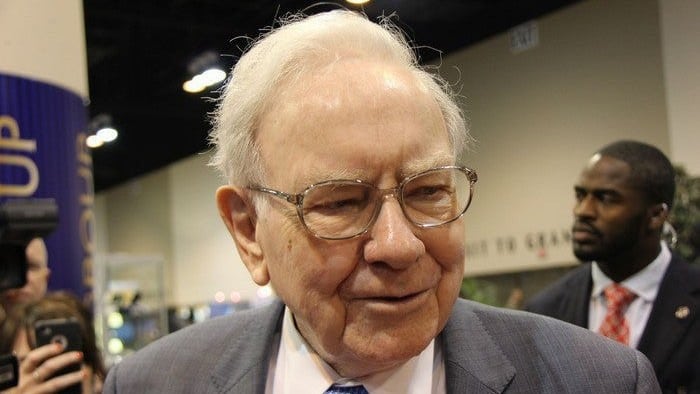

Warren Buffett is by far the most famous investor in the world. Most investors would know at least part of his phenomenal story of transforming Berkshire Hathaway Inc (NYSE: BRK.A)(NYSE: BRK.B) from the failing textiles mill that it was in the 1960s to the diversified, US$700 billion behemoth it is today.

Berkshire is one of the most unique companies out there. It functions as something of an investing house, owning dozens and dozens of individual businesses, both partially and completely. Some of its most famous positions include Coca-Cola Co, American Express and Apple. But Berkshire owns everything from Amazon stock to the entirety of Duracell batteries.

Another thing Berkshire is famous for is the company's aversion to paying dividends. Buffett has only had Berkshire pay out one dividend since the 1960s (in 1967), and he's long joked that he must have been in the bathroom when that decision was made.

So Berkshire has had its taps turned off tight when it comes to paying out dividends to its own investors. But that doesn't mean that Berkshire is opposed to receiving dividends from its own investments. In fact, Berkshire is one of the largest recipients of other companies' dividends that you'll find.

Warren Buffett will net a cool $9 billion in dividend income this year

As our Fool colleagues over in the US recently estimated, Berkshire is on track to pocket almost US$6 billion (over $9 billion) in dividend payments in 2023 alone. Most of that dividend income is going to come from just a few companies.

It is estimated that Berkshire will trouser just over US$900 million in dividends from Bank of America alone. Its Apple position (by far Berkshire's largest at 47% of its portfolio) will bring in another US$880 million or so. And ditto with Chevron and Coca-Cola.

But it's not the sheer scale of these divided payments that is most admirable. It is where they've come from.

Buffett first bought his Coca-Cola position just after the 1987 stock market crash. He ploughed around US$1.3 billion into the stock and has barely touched the position since the early 1990s.

So it's rather remarkable that in 2023, Buffett is on track to bag around US$736 million in dividends from this single position. That would be a 56.6% yield on his original investment for this year alone. It also tells us that this investment has paid for itself with dividends many times over.

Be like Warren and get a 56% yield

For all income investors, this should be held up as the Holy Grail of dividend investing. The aim of the game is to find quality dividend shares that will continue to up their income game every single year. So what shares can we look to if we want to 'be like Warren'?

Well, a perfect candidate would be Washington H. Soul Pattinson and Co Ltd (ASX: SOL). Earlier this week, we discussed whether Soul Patts was the ASX 200's greatest dividend share, thanks to its 22-year streak of raising its annual dividend. Other ASX dividend shares with strong income track records include Coles Group Ltd (ASX: COL) and WiseTech Global Ltd (ASX: WTC).

So be like Warren Buffett, and try and find a company that will give you a 56% yield on your capital in 35 years' time. That won't be easy, but hey, neither is winning the lottery.