It's little wonder why so many Aussies are fans of Core Lithium Ltd (ASX: CXO) shares.

The S&P/ASX 200 Index (ASX: XJO) stock has been a true market success story, surging more than 2,000% over the last five years. During that time, it hit a minuscule low of around 2 cents and an eye-popping high of $1.87. Core Lithium shares were trading at $1.08 at the close on Monday.

But is the party over for the newly turned lithium producer, or has it only just started?

We posed this question to two of our team, each with opposing views on the future of the lithium favourite. Keep reading to uncover the duo's bull and bear cases for Core Lithium shares.

A great ASX 200 option to ride the resurgent lithium boom

By Bernd Struben: Core Lithium shares look particularly well-positioned to ride the resurgent lithium boom.

From a charting perspective, the technicals for the stock look good, with a series of higher highs and higher lows since 23 March. That's seen CXO gain 42.37% in just two months. And while you should expect plenty of volatility, I believe there are more outsized gains to come.

Core Lithium attracted a lot of short-sellers after lithium prices began to nosedive in November, dropping more than 70% before bottoming in April. But the price of the battery-critical metal has since leapt 20% as electric vehicle (EV) sales once again pick up pace in China. And last year's oversupply of batteries is fast turning into an undersupply.

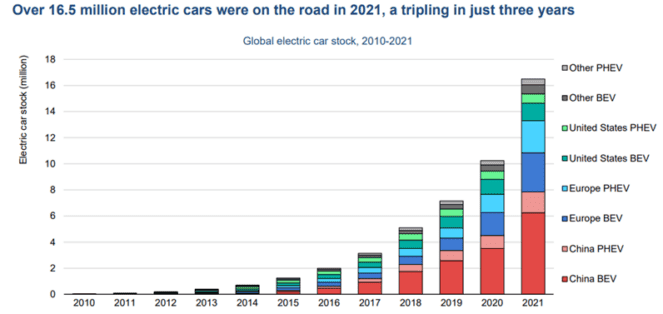

As for the broader outlook for EVs, this chart from the International Energy Agency showing the growth through to 2021 speaks 1,000 words.

Source: International Energy Agency

Project 'well placed'

I think Core Lithium is particularly well placed with its Finniss Lithium Project located close to Port Darwin.

And the timing of the project couldn't be better.

Finniss achieved first spodumene concentrate production in February. The miner's maiden 3,500-tonne spodumene concentrate parcel was transported to Darwin in March and early April.

On completion, Finniss will produce an average of 160,000 tonnes of battery-grade lithium concentrate per year over an initial 12-year mine life.

Now, Core Lithium does have a smaller resource than some of its peers. However, on 18 April, it announced the Finniss Mineral Resource had increased by 62%.

Other positives

The miner is also spending up on exploration, announcing a record $25 million drilling program targeting life-of-mine extensions and testing expansion potential.

Core owns a wide range of other projects (lithium and uranium) in the Northern Territory and South Australia, many situated close to major infrastructure. So, I'm not overly concerned with its current lithium resource.

As for the balance sheet, Core looks to be sufficiently funded to see it through to scaled-up production, holding $98 million in cash as at 31 March.

A trio of bearish arguments

By Brooke Cooper: While there are plenty of arguments for buying Core Lithium shares, I have three glaring reasons to avoid the stock. The first is the space the company operates in.

Demand for lithium will likely soar over the coming years amid continued growth in the adoption of electric vehicles and the decarbonisation movement.

However, some experts – looking at you, Goldman Sachs – also forecast supply will grow alongside demand, perhaps even outpacing it.

That means there's a reasonable risk the battery-making material's value could stagnate, or even fall, over the long term, taking the earnings of producers with it.

That might be particularly impactful for companies like Core Lithium. It's still predominantly an explorer and developer.

Its current production is coming from its Finniss Lithium Project's Grant Pit mine. The mine's mineral resource estimate dropped 2% last year to 2.91 million tonnes at 1.47% lithium oxide due to mining depletion.

The company is currently looking to develop its BP33 deposit and is forking out $25 million on exploration this year.

Thus, my preferred exposure to lithium is through established and proven lithium producers such as Pilbara Minerals Ltd (ASX: PLS) and Allkem Ltd (ASX: AKE).

Too expensive

That leads to my second point. Core Lithium is considered to be more expensive than many of its peers.

Goldman Sachs rated the stock a sell late last month, noting its valuation sits at 1.4 times its net asset value, compared to an average of around 1.1 times among its peers.

The broker also flagged that Core Lithium is pricing in at around US$1,600 per tonne of spodumene. This compares to an average of US$1,100 a tonne among its peers.

And I'm not alone in my scepticism of Core Lithium shares.

Short impact

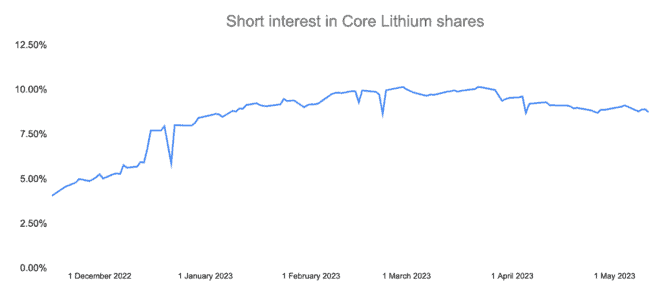

The final reason I remain bearish is the company's whopping short interest.

While short-sellers don't have a direct impact on a company or its stock, the cynicism they represent can reflect market sentiment, thereby creating a risk of its own.

Take a look at how the short interest in Core Lithium shares has grown over the last six months, according to data from Australian Securities & Investments Commission (ASIC):

The measure peaked at 10.17% in February and again in March. It has since dropped to a still-significant 8.7% at last count – making the stock the market's fourth most shorted share.

All in all, while I think it's possible, and even potentially likely, that Core Lithium shares could appreciate from here, I would rather invest my hard-earned cash elsewhere. Perhaps in more established lithium miners.