Ask a Fund Manager

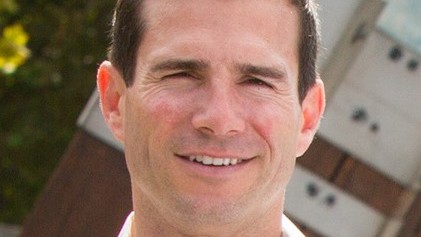

The Motley Fool chats with fund managers so that you can get an insight into how the professionals think. In part one of this edition, we're joined by Kristiaan Rehder, portfolio manager of the Bennelong Kardinia Absolute Return Fund.

The Motley Fool: Unlike many funds, you invest in both ASX shares that you think will gain in value as well as ASX stocks you believe will see their share prices fall. What are the advantages to that strategy?

Kristiaan Rehder: We're a long short fund. This means we have twice the investment opportunities as a long only manager. If a long only manager comes across a company that they identify has red flags, they tend to put their pens down at that point.

For Kardinia, we can extend the research and potentially profit from that trade by going short. And that can be very powerful.

To illustrate, the short book for the month of September contributed around 350 basis points to our performance.

We're what's referred to as a variable beta fund, which means we can adjust our net exposure depending on how bullish or bearish we are.

MF: Has the fund every been 100% long or entirely short?

KR: We're capped at 75% net long and we cannot exceed 25% net short. The ability to vary the net exposure is no different from how I think an investor would manage their own money. They can get more exposure to the market if they're bullish. If they are bearish, they can go to cash. In our case we can go to cash and also short.

So, we're not bound to be fully invested at all times, which is a characteristic that most fund managers in Australia have to abide by.

We've got a long track record of 16 years. One of the longest running absolute return funds in the Australian marketplace. And the strategy has been tested over that time in all market conditions.

MF: How does that strategy impact the volatility of your returns?

KR: We've beaten the market return over the 16 years and we've done that with about half the volatility of the underlying markets. The standard deviation of the fund, a common measure of volatility, is around 7%, versus the underlying market which is about 14%.

This comes to the fore during bear markets, where the strategy has a history of protecting the capital.

Back in 2020, with COVID, at the worst point the market was down 36% and we were down 4%. And during the GFC in 2008, the market was down over 40%, and we generated a positive return.

MF: Do dividends from ASX shares play a role in determining your investment decisions?

KR: They certainly do. Kardinia is very focused on dividends. Particularly fully franked dividends, because they're obviously so valuable to underlying shareholders.

The Australian marketplace is a very high yielding market compared to other markets around the world.

To illustrate the importance of dividends to the Australian market, if you look at the S&P/ASX 300 Index (ASX: XKO), that's returned about 2.8% per annum over the last five years. If you compare that to the ASX 300 accumulation index, which includes dividends, it's around 6.8%. So that 4% difference per annum is all to do with dividends.

MF: Do you have any advice to readers hunting for ASX dividend shares on their own?

KR: It's simply not enough to invest in high dividend paying companies. It's also important to ensure that those dividends are sustainable.

Some of the things we look at to ensure the dividend is sustainable are a strong balance sheet; good cash conversion on the profit loss and cash flow statements; and sensible management.

We're also very interested in companies we think are likely to experience a dividend cut, as these companies can often provide interesting opportunities on the short side of the business.

MF: Atop trying to ensure that the dividend yields from the ASX shares you're investing in are sustainable, what else do you look for from an income stock?

KR: We've extended beyond just dividends. We're also looking at capital management, such as buybacks and capital returns.

BHP Group Ltd (ASX: BHP) is a stock in our portfolio which we bought ahead of capital management.

BHP paid an enormous dividend in its most recent reporting season. It declared a final, fully franked dividend of about US$9 billion. And that's done very well for us.

We still hold BHP now, and we are favourably disposed to resources generally. We think there is likely to be ongoing demand for the commodities that BHP produces.

We also think it's likely that at some point over the next six months the Chinese economy will be stimulated. Due to the COVID restrictions that are currently in place and the slowing economy that's being experienced, there's a reasonable chance that stimulus will be used to support the economy. And we think BHP will be well positioned for that.

There's another company which is of particular interest to us. It's been out of favour for some time, and that's AMP Ltd (ASX: AMP). Our analysis shows that there's considerable excess capital. And we think it can surprise the market in regards to the extent of its capital returns in the near term.

**

Tune in tomorrow for part two of our interview, where Kristiaan Rehder explains the ins and outs of how to successfully short ASX shares.

(You can find out more about the Bennelong Kardinia Absolute Return Fund here.)