This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The stock market sell-off of 2022 led to a sharp decline in the value of some high-profile names that once traded at (or near) the eye-popping market cap of $1 trillion.

Tesla (NASDAQ: TSLA) and Meta Platforms (NASDAQ: META) are two big tech names that became trillion-dollar companies before the broad market sell-off dented their market caps significantly. Tesla, for instance, currently has a market cap of $840 billion. But the electric vehicle specialist was trading above the $1 trillion market cap milestone in October 2021.

Similarly, Meta Platforms stock has fallen off a cliff, and it now sports a market cap of $366 billion. The social media giant had hit a $1 trillion market cap in June last year when it was known as Facebook. Meanwhile, high-flying semiconductor company Nvidia (NASDAQ: NVDA) was close to hitting the $1 trillion milestone at the end of last year, when its market cap stood at over $800 billion. But the 58% decline in Nvidia stock this year has brought its market cap down to $304 billion.

But don't be surprised to see these three tech giants regain the $1 trillion market cap milestone within the next decade, or maybe sooner. Let's see why that may be the case.

1. Tesla is close to regaining the $1 trillion mark

Of the three companies discussed, Tesla is the closest to the $1 trillion milestone. And the company could hit that mark well within the next 10 years given its impressive growth and the massive opportunity in electric vehicles (EVs).

Tesla is a high-growth company whose revenue shot up 42% year over year in the second quarter of 2022 to $16.9 billion. What's more, the company is also enjoying solid pricing power, as an increase in the average selling price of its vehicles led to an improvement of 358 basis points in its operating margin during the quarter to 14.6%. The solid top-line growth and the margin expansion led to 57% year-over-year growth in adjusted earnings to $2.27 per share in Q2.

With the global electric vehicle market expected to clock a compound annual growth rate (CAGR) of 29% through 2030 and hit annual sales of 31.1 million units as compared to 2.5 million units in 2020, Tesla has a lot of room to sustain its terrific growth. Of course, the growing competition in the EV space will be a challenge for Tesla, but it is worth noting that the company is successfully growing despite that.

Tesla's share of battery electric vehicles in key markets such as China, Europe, and the U.S. has dropped to 15.6% in the second quarter of 2022 from 25% in the second quarter of 2020. However, the company's deliveries have increased by a massive 180% during that period. Tesla delivered nearly 255,000 vehicles in the second quarter of 2022, compared to nearly 91,000 a couple of years prior.

Given that Tesla is aggressively expanding its capacity to take advantage of the secular growth in EVs, it is not surprising to see that analysts are expecting its earnings to increase at an annual pace of 55% over the next five years. Additionally, Tesla's median Wall Street price target of $329 per share points toward a 23% upside from the current levels over the next 12 months, taking this electric vehicle company's market cap beyond $1 trillion.

2. Meta Platforms has work to do, but it could get there

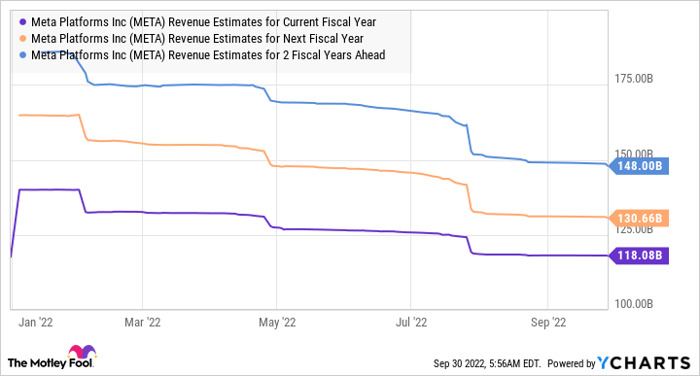

Meta Platforms' spectacular fall over the past year or so can be attributed to multiple factors. A slowdown in ad spending, surging inflation, and macroeconomic uncertainty have created an unfavorable operating environment for the company. That's why analysts expect Meta's top line to remain flat in 2022 at $118 billion. The company's earnings are expected to drop to $9.87 per share this year from $13.77 in 2021.

What's more, Meta's move to reduce its expenses for 2022 by keeping a handle on hiring, or even resorting to layoffs, indicates that the social media giant is in for tough times. But there are a few reasons why Meta's tough times won't last forever, and the company should eventually come out of its slump in the long run.

For instance, annual digital ad spending is expected to jump from $521 billion in 2021 to $876 billion in 2026, according to eMarketer. Along with Alphabet, Meta is the other massive player in the digital ad spending space, with the two companies holding a combined market share of 53.2% last year. Meta alone generated $115 billion in advertising revenue last year, which means that it controlled around 22% of this space as per eMarketer's industry revenue estimate.

Of course, growing competition from the likes of Amazon and Apple is expected to put Meta's market share under pressure. But the latter's move to make money from advertising in emerging niches such as the metaverse could help it sustain its solid share and improve its top line. This explains why analysts expect Meta's revenue to start growing once again from next year and accelerate in 2024.

META Revenue Estimates for Current Fiscal Year data by YCharts

If Meta retains a 20% share of the digital ad spending market in 2026, then its top line could increase to $175 billion based on eMarketer's forecast. This excludes the potential gains from emerging catalysts such as the metaverse. Multiplying this potential revenue estimate by Meta's five-year average sales multiple of nine would translate into a market cap of well above $1 trillion. But if we decide to use a lower sales multiple to account for the competition that could arise in the next few years -- let's say a price-to-sales ratio of five after five years -- Meta would be close to hitting the milestone it had achieved last year.

In all, Meta looks well-placed to become a trillion-dollar company over the long run, which is why buying the stock looks like a good idea as it is trading at just 11 times trailing earnings right now.

3. Nvidia's multiple catalysts could make it a trillion-dollar company

Nvidia is in a rough patch this year thanks to the slowdown in demand for graphics cards used in gaming personal computers (PCs), and it recently stumbled upon a new headwind in the data center business after the U.S. government imposed restrictions on sales of chips to China.

Investors, however, would do well to focus on the bigger picture. That's because Nvidia is the leading player in a couple of massive markets that are built for long-term growth, and it is also pursuing opportunities in emerging areas such as automotive and digital twins.

For instance, Nvidia controlled 79% of the market for gaming graphics cards in the second quarter of 2022. This market is in bad shape right now thanks to an oversupply caused by weak demand and higher supply. However, the situation should improve in the long run, as sales of gaming graphics cards are expected to increase at an annual pace of 14% through 2026, presenting a solid opportunity for Nvidia to grow revenue thanks to its impressive market share.

Meanwhile, Nvidia's growing influence in nascent areas such as digital twins could supercharge the company's long-term growth by opening a whole new opportunity to tap. All this explains why Nvidia's earnings are still expected to clock annual growth of 23% for the next five years despite the challenges it has faced in 2022, according to consensus estimates.

Applying analysts' projected earnings growth to its current fiscal year's estimated earnings of $3.37 per share would translate into a bottom line of nearly $9.50 per share after five years. Multiplying the anticipated earnings after five years with Nvidia's five-year-average forward earnings multiple of 40 gives us a $380 price target after five years. That points toward 210% gains from the current levels.

As Nvidia has a market cap of $304 billion now, a 210% gain in five years means that the company would be worth close to $950 billion in 2027. And if we consider that this tech giant has solid catalysts that could help sustain its outstanding growth for the next decade, it wouldn't be surprising to see it attain a $1 trillion market cap within the next 10 years.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.