This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In today's volatile market, it's not hard to find growth stocks that trade at huge discounts compared to their highs. Amazon (NASDAQ: AMZN) and Netflix (NASDAQ: NFLX) are two FAANG stocks trading far below peak levels, and investors might be wondering which former highflier is the better buy. Read on to see where two Motley Fool contributors come down on this tech stock valuation debate.

Netflix is the streaming content trailblazer

Parkev Tatevosian: Netflix has pioneered a new form of content consumption through streaming. The company boasted 222 million subscribers as of March 31. Much has been made about its slowdown in subscriber growth. Netflix shed 200,000 subscriptions in its most recently completed quarter and is forecasting a loss of two million more in the current quarter. The market didn't respond well to these latest numbers and accelerated the stock sell-off. However, investors have arguably overreacted to the bad news.

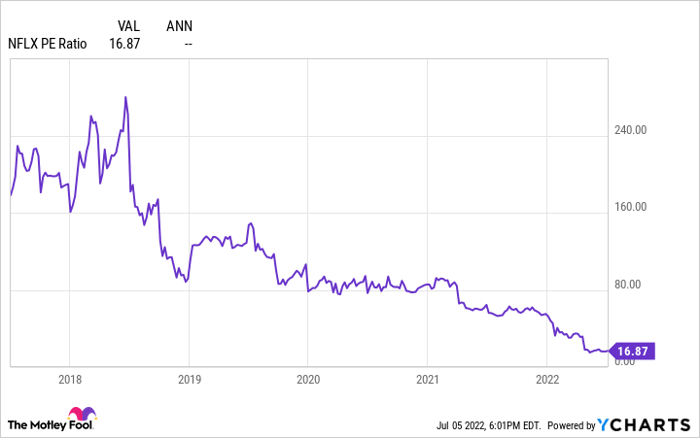

NFLX PE Ratio data by YCharts.

Netflix stock is trading at a price-to-earnings (P/E) ratio of 16.9, which is the lowest in the last five years. Meanwhile, it was expected that growth would slow following the surge in subscriber additions at the onset of the pandemic that pulled a lot of growth forward. The economic reopening has created more options for what people can do with their time, and after being cooped up at home for more than a year, it's understandable that they want to get out of the house and use less Netflix.

That change of pace by users should not be mistaken for a structural decrease in demand for Netflix's services. For less than $20 per month, a family can get entertainment that can be accessed anywhere they can take a mobile device or have internet access. That excellent customer value proposition will likely fuel growth for several more years.

At Netflix's scale, it was already good enough to deliver revenue of $29.7 billion and operating income of $6.2 billion in 2021. It has foundational economies of scale that rapidly expand profits with incremental revenue growth. That's because it will cost Netflix roughly the same to show its content to 500 million subscribers as it does to 200 million.

Amazon is built for growth thanks to strong moats

Keith Noonan: Amazon stock has fallen roughly 30% year to date and 39% from its lifetime high. With the company valued at roughly 2.3 times this year's expected sales and 143 times expected earnings, it still has a much more growth-dependent valuation than Netflix. However, I also think it stands out as a better buy for long-term investors.

With fuel and other shipping and logistics costs rising, Amazon's e-commerce business is facing some major headwinds at the moment. Coupled with big investments in online-retail infrastructure and technology spending, current conditions are creating significant setbacks for profitability right now.

However, Amazon Web Services continues to account for a greater portion of the company's overall sales profile, and the business has a strong industry position and a fantastic net income margin. Despite rising expenses, Amazon's e-commerce and cloud infrastructure segments look incredibly well-positioned for long-term growth, and competitors will have great difficulty disrupting the company's dominant positions in these spheres.

Meanwhile, Netflix carries a lot of debt, and it looks like the business model that was formerly so successful for the company is no longer capable of delivering the kind of performance investors are looking for. While the streaming leader has undeniably created some big hits, it also seems to have pursued a quantity-over-quality approach to building out its library, and its content has lost some luster now that competitors are rapidly finding their footing in the streaming space. I wouldn't be shocked to see Netflix stock bounce back from recent pricing lows, but the business doesn't strike me as special anymore.

So which is the better buy?

When it comes to deciding between Amazon and Netflix, investors should probably start by deciding which business they think looks stronger and then balancing that assessment against growth expectations and valuation levels. If you're looking for a more value-oriented stock with a less growth-dependent valuation, Netflix may prove to be the better buy. However, if you're more concerned about long-term moats and market positioning, Amazon might be a better fit.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.