This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

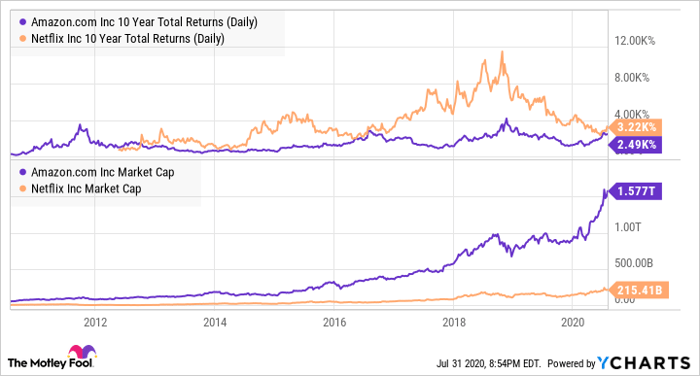

Most investors are quite familiar with both Netflix (NASDAQ: NFLX) and Amazon.com (NASDAQ: AMZN), not only as far as their products and services go, but also their stocks. After all, both Netflix and Amazon have become truly massive long-term winners over the past decade, with Amazon up 2,490% and Netflix up an even more stunning 3,220% over the past 10 years. Their outperformance has earned them the title of being 40% of the famed FAANG cohort of leading U.S. consumer-facing internet stocks.

Data source: YCharts.

In general, industry leaders and winners tend to keep on winning, and both Netflix and Amazon still look like strong long-term picks today. But if you're looking to add to one of these two pillars of the U.S. tech industry or even buy shares for the first time, which is the better bet today?

The case for Netflix

Netflix is up a whopping 50% on the year, as the government shelter-in-place order spurred an acceleration in net subscriber adds in both the first and second quarters. Netflix has long operated with low profits and actually negative free cash flow, since it must invest ahead of content coming out. Therefore, analysts have long looked at subscriber additions as a key metric. In just the first half of the year, Netflix has already added an additional 26 million subs versus just 12 million additions in the first half of 2019.

As the first mover and leader in global streaming, Netflix proved a go-to during the pandemic, proving its customer value proposition even after price increases for its standard plan in 2014, 2015, 2017, and 2019. The ability to increase subscribers while also raising prices is one of the reasons Netflix's valuation has skyrocketed over the years.

While Netflix has rapidly grown to almost 193 million members as of last quarter, Jefferies analyst Alex Giaimo thinks Netflix can continue growing strongly for years, even though the U.S. is nearly fully penetrated. Gaimo believes that when taking into account both broadband households and mobile-only customers on a global basis, Netflix has an addressable market of 850 million.

Netflix is currently at around 65% penetration in the U.S, so applying that to the entire globe, Netflix could potentially rack up 550 million subs over time. Though the rest of the world is likely to be lower-penetration and perhaps lower pricing than the U.S., Netflix could still feasibly double its subscriber count over the long-term. Add in a few price increases along the way, and it's not difficult to see Netflix generating serious cash flow five or 10 years out.

The case for Amazon

Not only does Amazon have a rival streaming service to Netflix, which is grouped with its Prime Video offering, but it's also the undisputed leader in U.S. e-commerce and enterprise cloud computing, and it's an ascendant force in digital advertising as well. In fact, you could say that Amazon doesn't really operate in a single industry; it's more of a business concept, dedicated to customer convenience, low prices, and continuous innovation on many fronts.

By design or coincidence, most of Amazon's segments not only survived but also benefited from the COVID-19-related quarantines in the recently reported second quarter:

|

Segment |

Q2 2020 Revenue Growth (YOY, excluding FX) |

|---|---|

|

Online stores |

48% |

|

Physical stores |

(13%) |

|

Third party sellers |

52% |

|

Subscription services |

29% |

|

Amazon web services |

29% |

|

Other (mostly advertising) |

41% |

|

Total |

40% |

Data source: Amazon Q2 2020 earnings release. YOY=year-over-year.

Not only has Amazon been growing at a white-hot pace despite its already-massive size, but it's also beginning to show some of the profit potential investors have wondered about for years. Despite an extra $4 billion in COVID-19 related costs, operating income surged a whopping 89% on a constant currency basis last quarter to $5.8 billion. Even the perpetually loss-making international segment, encompassing e-commerce operations in Japan, Europe, India, Brazil, the Middle East, and others, swung to an operating profit for the first time. While AWS actually decelerated to "just" 29% growth, as Amazon offered cost breaks to clients in beleaguered industries, AWS operating income grew at double that rate at 58%, as AWS appears to be generating huge operating leverage off its fixed cost base.

Amazon has traditionally reinvested all of its profits into improving its service, such as the introduction of one-day shipping last year, as well as innovating in new areas, such as the recent acquisition of electric autonomous vehicle-maker Zoox; however, it appears the company is now making so much money that it can't seem to spend it all -- at least, not last quarter! Once Amazon's various businesses reach "maturity," which, from the looks of it, appears a long, long ways off, its profit potential looks to be enormous.

How to decide?

Investing in either Netflix or Amazon is rarely a bad idea. However, there are a few elements that make me choose Amazon over Netflix at the current moment.

The biggest factor is that Amazon is truly diversified across many high-growth segments of the digital economy, whereas Netflix is hyper-focused on being the best streaming video subscription service in the world. Both diversified or hyper-focused business strategies can be very successful, but in today's market, in which stock prices are fairly high and there is a great amount of uncertainty, I'd go for the more diverse company in Amazon.

After all, while Netflix is the leader in streaming, there is also an influx of competition coming in the form of both traditional media companies as well as tech giants launching their own streaming services, just in late 2019 and into 2020. While I don't think any of these streaming services will overtake Netflix, they could crimp either Netflix's subscriber growth or margins in competitive markets, making Netflix's ultimate profitability a bit of a question mark.

Meanwhile, I like that Amazon dominates in both e-commerce and cloud computing, each of which has extremely high barriers to entry. I also like that Amazon is challenging the digital advertising leaders now, and that it continues to experiment and innovate, with the Zoox acquisition being a prime example, giving investors more "call options" on future potential products.

Though it's probably a good idea to own both stocks, and I own both today, Amazon is actually my largest position, whereas Netflix is much, much smaller. That's due to Amazon's unique culture, business model, and mix of both defensive and offensive characteristics, making it my choice today even after its post-earnings bump.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Billy Duberstein owns shares of Amazon and Netflix. His clients may own shares of the companies mentioned. The Motley Fool owns shares of and recommends Amazon and Netflix and recommends the following options: short January 2022 $1940 calls on Amazon and long January 2022 $1920 calls on Amazon. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.