Even just 1 ASX share with a return of 1,000% or more is enough to supercharge the returns of your share portfolio. To see this, consider the following example of 2 simple $10,000 portfolios containing shares in 10 companies.

The example

For simplicity, assume both portfolios contain equal $1,000 amounts in each of the 10 shares.

Portfolio 1

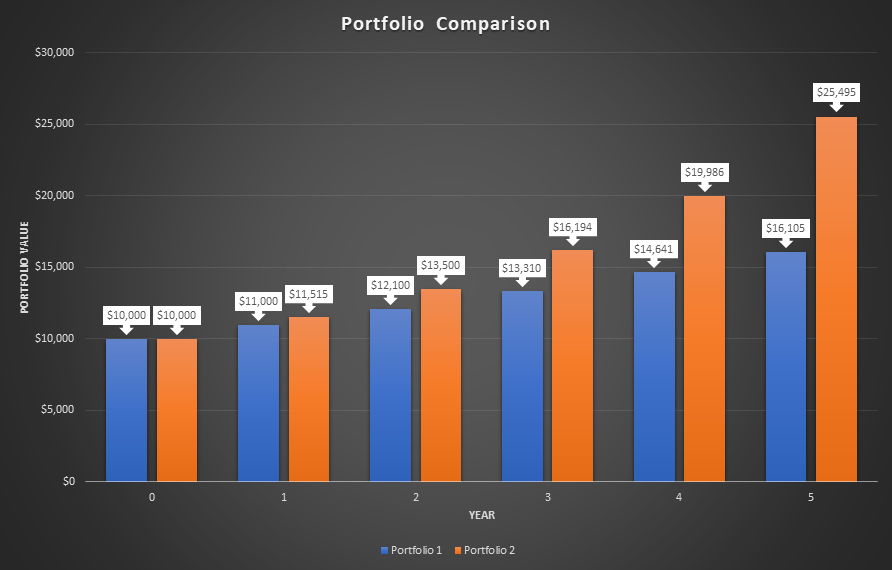

For portfolio 1, assume an annual return of 10% per year. This gives us the following portfolio value after 5 years:

Portfolio Value = $10,000 x [(1.1)^5] = $16,105

Portfolio 2

For portfolio 2, also assume an annual return of 10%. However, this will only be for 9 shares in the portfolio, with the 10th share returning 1,000% over the 5 years – or a compounding annual return of 61.54%. After 5 years, the value of the portfolio would be:

Portfolio Value = $9,000 x [(1.1)^5] + $1,000 x [(1.6154)^5] = $25,495

Portfolio Comparison

As you can easily see in the chart below, just finding one of these '11 baggers', or shares returning 1,000%, is enough to significantly boost your portfolio returns. By a difference of an amazing 58% in just 5 years in the above example.

2 ASX shares returning 1,000% over the last 5 years

While there would have been a number of companies reaching this coveted return over the last 5 years, most would be unknown to the majority of investors. However, I'm sure many people have heard of A2 Milk Company Ltd (ASX: A2M) and/or Altium Limited (ASX: ALU). Both of these companies have given investors the chance at a 1,000% return in the past 5 years.

a2 Milk

a2 Milk shares listed on the ASX just over 5 years ago, selling for just 56 cents per share. However, a couple of months later in May 2015, the shares closed for just 47 cents. At the time of writing, a2 Milk shares are trading today, 5 years later, at a staggering $18.37 each. This is an astonishing 39 bagger in just 5 years. Or a return of 3,800%.

Altium

If you were lucky enough to pick up shares in the PCB software company in August 2015 at $3.71, you would've been sitting on a return of 1,049% in February this year prior to the market crash. However, even despite this crash, the return today would be a massive 857% or a '9 and a half bagger'. But only if you had managed not to sell the shares in the meantime.

Foolish takeaway

As shown above, managing to find and invest in just a single company with these returns can have dramatic results for your portfolio's performance.

Of course, shares like these are not easy to come across, and often even harder to hold onto during the often volatile ride to a 1,000% turn. Both a2 Milk and Altium experienced significant drops along the way.

However, finding growth companies early, within a large expanding industry, and spreading your funds over multiple candidates for the long term is one way to increase your chances of owning one in your portfolio.