The small-cap or 'casino' end of the share market is a veritable minefield suitable for highly-experienced investors only.

However, this does not stop beginner investors or speculators regularly trading shares in the hope of a quick profit, or in the hope of buying that 1 in a 1,000 company that goes on to be a huge winner.

It's true that this end of the market can produce massive winners returning say 5,000% in just 5 years or more like Pro Medicus Limited (ASX: PME) or Nearmap Ltd (ASX: NEA), but finding these companies amongst today's contenders is a tough task that requires expertise and a little luck.

I don't propose to cover the below companies on the list below in much detail, but rather to make a couple of points around small or micro-cap speculating.

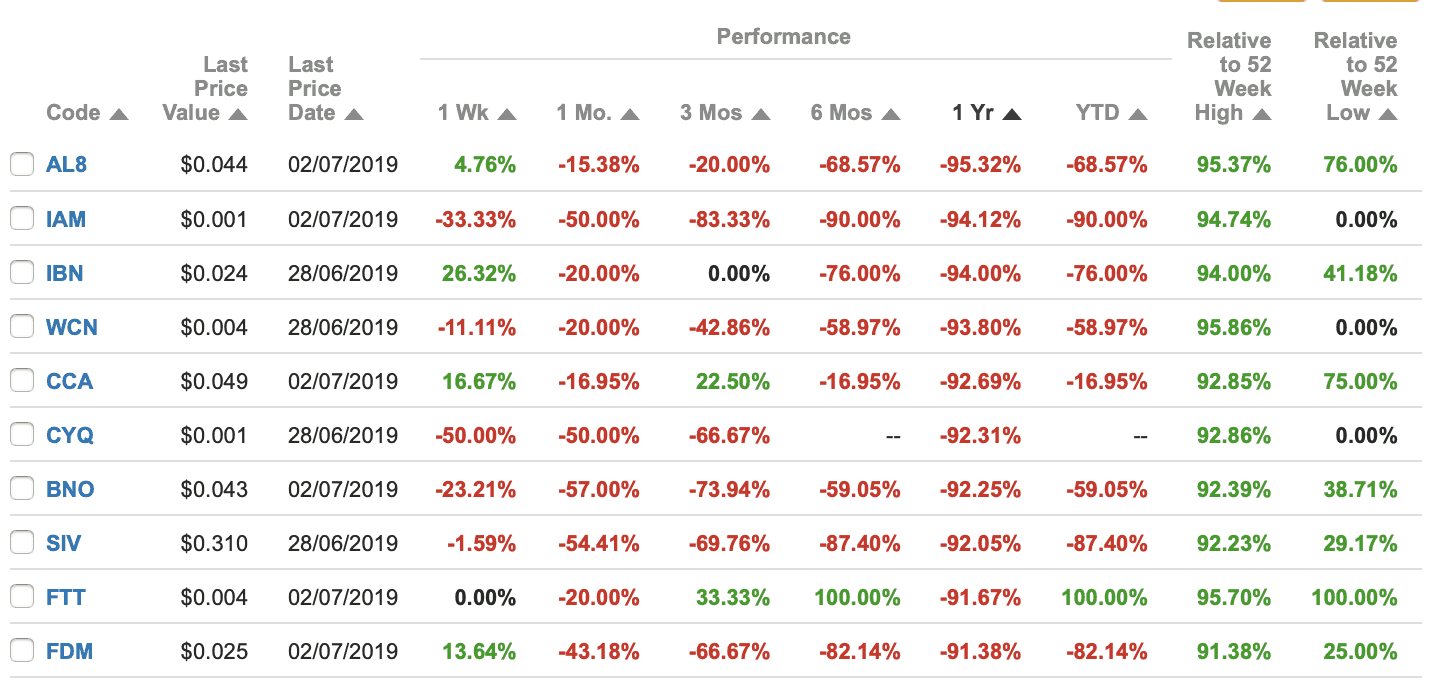

As you can see most of the companies below have lost around 95% of their value over the past year.

If you lose 95% of your investment say from $100 to $5, you will need to make 1,900% just to get back to $100 again. An almost impossible task.

So speculating at this end of the market as a novice investor could permanently destroy your investment capital and end up excluding you from the real wealth creating mid and large-cap ends of the share market where small fortunes can be made without taking silly risks.

The speculative end of the market is also lightly regulated and deliberately so, the principle of caveat emptor or "buyer beware" rules as most micro-cap companies are unprofitable or have little revenue. In other words they list to raise capital more than to allow 'mum and dad' investors to trade shares.

Raising capital is after all one of the two primary functions of stock markets.

As for most companies at this end of the market with little or no revenue bank debt is not an option. As bankers are definitely not foolish enough to lend.

This means every company at this end of the market will have an attractive story to sell to investors, but very few will go onto become big winners.

The light regulation also means this end of the market attracts plenty of dubious operators often perpetuating some of the oldest tricks in the share market scam book to profit for themselves. Anyone who loses money at this end of the market though has little recourse other than to blame themselves for their stupidity.

"The fault dear Brutus is not in the stars, it is in ourselves".

With Shakespeare's advice in mind let's take a brief look at the 10 worst small caps of FY 2019 according to Commsec.

Source: Commsec, July 3 2019.

Alderan Resources Ltd (ASX: AL8) is a copper mining explorer in Utah, USA. It raised $1.6 million from investors via a placement in May 2019.

Intiger Group Ltd (ASX: IAM) reports it operates a software development house to assist financial planners. The stock sits at 1 cent.

iBuyNew Group Ltd (ASX: IBN) is a residential property buying advisory group. The stock is down 94% in a year.

White Cliff Minerals Ltd (ASX: WCN) is a gold explorer focused in the Kyrgyz Republic and nickel-cobalt explorer in Western Australia. It raised $1.15 million (before costs) from investors earlier in 2019.

Change Financial Ltd (ASX: CCA) is in the "fintech" and payments technologies space. Investors appear unimpressed given the stock price.

Cycliq Group Ltd (ASX: CYQ) is a bicycle accessories business. It looks to have a long road ahead of it.

Bionomics Ltd (ASX: BNO) is a biopharmaceutical company researching treatments for anxiety, Alzheimer's and other common ailments. Speculative biotech stocks commonly bomb at the small-cap end of the share market on failed trial results.

Silver Chef Limited (ASX: SIV) is a kitchen equipment leasing business that ran into trouble in FY 2019 on the back of ballooning losses.

Factor Therapeutics Ltd (ASX: FTT) is a speculative biotech researching wound care therapies.

Freedom Oil and Gas Ltd (ASX: FDM) is an oil and gas exploration company in Texas. Looking at the share price it's better at spending money than making it.