The S&P/ASX 200 (Index:^AXJO) (ASX: XJO) is facing a consensus profit downgrade cycle, warns Credit Suisse, but there's something that can save us from the pain.

The top 200 stock index has gained 9% over the past year with large cap outperformers like CSL Limited (ASX: CSL), Macquarie Group Ltd (ASX: MQG) and Aristocrat Leisure Limited (ASX: ALL) leading the charge.

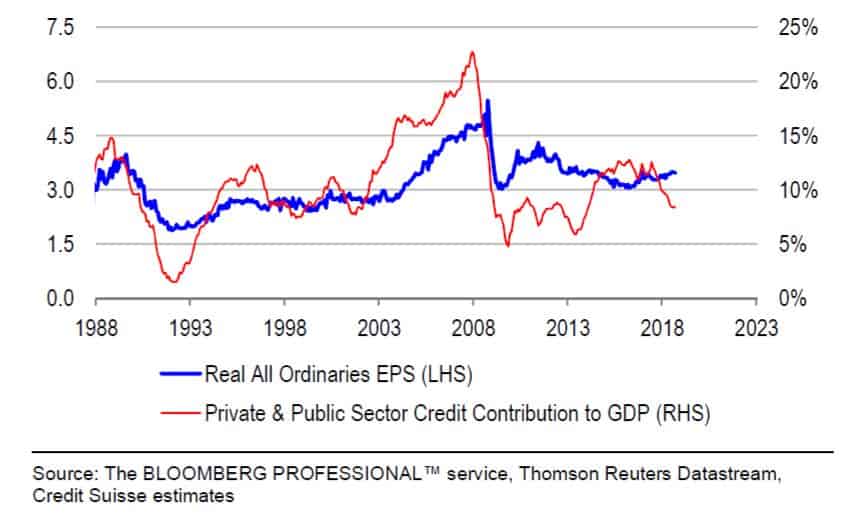

But we are heading into a credit constrained environment thanks in no small part to the Banking Royal Commission, although this risk is not factored into current share prices. This is a big problem as credit growth is strongly linked to earnings per share (EPS) growth, according to Credit Suisse which has constructed a model to explain and predict real market EPS.

"Recently, credit growth has slowed, but analyst EPS estimates have not [come] down," said the broker.

"Also, going forward, tighter credit conditions are likely to lead to even slower credit growth, with the government not committed to a strong counter-cyclical fiscal response."

Not Credible: Real market EPS and credit growth

Analysts are expecting high-single digit EPS growth for our market in FY19 and some are already warning that valuations are starting to look stretched based on this forecast.

A downgrade to earnings estimates will be a big blow to our enduring bull market and may even trigger a new bear market cycle.

But there's one probable thing that can help us avoid the pain. While Credit Suisse believes the biggest driver for EPS growth is the availability of credit, Australian-dollar denominated commodity prices are also a major factor.

"While slowing credit growth is a worry, we also think that there is upside to AUD-denominated commodity prices," said the broker.

"Leading indicators point to reasonable world growth, consistent with USD-denominated commodity prices remaining at high levels. At the same time, Australian-US yield differentials are likely to invert further, undermining the carry trade appeal of the currency."

The US Federal Reserve lifted interest rates again yesterday and signaled that more rate hikes are on the way. This should translate to a lower Australian dollar although the Aussie hasn't moved much on the news and is hanging on to above US72.5 cents.

Perhaps the more significant takeaway from Credit Suisse's model is where you should allocate capital in the market.

Even if the ASX 200 index can avoid an overall EPS downgrade due to commodity prices, it's resource companies like BHP Billiton Limited (ASX: BHP) and Oil Search Limited (ASX: OSH) that will be lifting the market, while banks like Commonwealth Bank of Australia (ASX: CBA) are likely to still get hit.