In morning trade the NEXTDC Ltd (ASX: NXT) share price has pushed higher following the release of its full year results.

At the time of writing the data centre operator's shares are up almost 3% to $7.56.

Here is how NEXTDC performed in FY 2018 compared to a year earlier:

- Revenue rose 30.6% to $161.5 million.

- Underlying EBITDA increased 27.7% to $62.6 million.

- Capital expenditure rose 79% to $285 million.

- Statutory net profit after tax down 71% to $6.6 million.

- Cash and term deposits of $718 million.

- Outlook: Growth of up to 23.8% for revenue and 28% for underlying EBITDA.

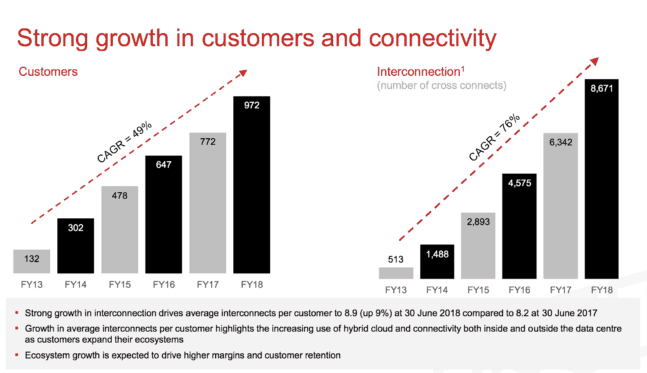

The strong top line growth, which outperformed its guidance of $152 million to $158 million, was driven by an increase in contracted utilisation, customer numbers, and interconnections. During the 12 months contracted utilisation rose 28% to 49.2MW, customer numbers increased 26% to 972, and interconnection (cross connects) jumped 37% to 8,671.

The strong demand that NEXTDC experienced led to annualised revenue per square metre rising 11.6% to $9,897 and annualised revenue per MW increasing 9% to $4.36 million.

It wasn't just its revenue guidance that the company outperformed in FY 2018. Its underlying EBITDA of $62.6 million was ahead of its guidance range of $58 million to $62 million and capital expenditure of $285 million was below its guidance range of $307 million and $327 million.

NEXTDC CEO Craig Scroggie appeared to be deservedly pleased with its results. He stated: "We continue to experience strong demand for NEXTDC's premium data centre services, with the Company experiencing not only strong growth in contracted utilisation, but also adding a record number of more than 2,300 interconnections during FY18. Furthermore, with NEXTDC currently in advanced negotiations in relation to further large customer opportunities, we expect to carry this strong momentum into FY19."

Outlook.

Based on contracted utilisation levels at the end of FY 2018, expected new customer contracts in FY 2019, further growth in connectivity revenue, and targeted investments in the cost base as its scale its operations, NEXTDC expects another strong year.

Based on current accounting standards, it has provided guidance for revenue in the range of $194 million to $200 million, underlying EBITDA in the range of $75 million to $80 million, and capital expenditure in the range of $430 million to $470 million. At the top end of its guidance this means growth of 23.8% for revenue and 28% for underlying EBITDA.

Should you invest?

I think this result demonstrates why NEXTDC could be a great long-term buy and hold investment. With the cloud computing boom continuing to gather pace, I expect demand for its services will continue growing at a strong rate for some time to come.

Overall, along with Macquarie Telecom Group Ltd (ASX: MAQ) and Megaport Ltd (ASX: MP1), I think NEXTDC is one of the best ways to gain exposure to the cloud computing boom. Though, its shares do trade at a significant premium, so this does make them a reasonably high risk investment.