This morning the Australian Bureau of Statistics (ABS) released its consumer price index (CPI) report outlining price inflation rates for the June quarter with year-on-year headline inflation in Australia now running at 2.1% and within the Reserve Bank's targeted range of 2%-3%.

However, underlying CPI or the weighted mean averages of adjusted inflation figures that the Reserve Bank (RBA) places more emphasis on came in at 1.9% growth for the year and 0.5% for the quarter.

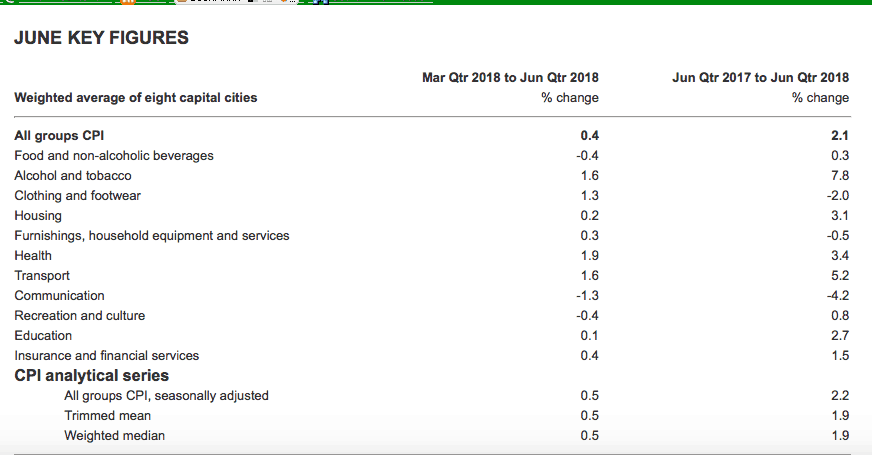

Below is the ABS's chart outlining all the numbers for the quarter.

Source: Australian Bureau of Statistics

As the ABS comments:

- "The most significant price rises this quarter are automotive fuel (+6.9%), medical and hospital services (+3.1%) and tobacco (+2.8%)."

- "The most significant offsetting price falls this quarter are domestic holiday travel and accommodation (-2.7%), motor vehicles (-2.0) and vegetables (-2.9%)."

The quarterly inflation report is critical to local financial markets and monetary policy as The RBA is mandated to target underlying inflation in Australia between 2% and 3% as this is considered a healthy level that promotes investment, borrowing, lending, and economic activity, without the value of money being eroded if inflation runs too high.

So with annual adjusted inflation at 1.9% (below the RBA's targeted 2%-3% range) the prospect of an interest rate hike over the next 12 months is remote.

This is good news for Australia's wobbly residential property market, although a worry generally for the wider economy as cash rates are already at a record low 1.5% to suggest that the RBA's fiscal stimulus is still not stimulating suffiicent demand that translates into inflationary presssure.

To some extent the RBA has a get out of jail free card because as its policy states "the inflation target is defined as a medium-term average rather than as a rate (or band of rates) that must be held at all times".

This flexibility provides its justification for keeping rates on hold as the inflation target is forward looking, even though inflation has been running below its targeted range for more than a year now.

For share market investors lower rates for longer mean defensive high-yield stocks are likely to remain popular as an alternative to the paltry returns available on cash term deposits at the banks, while stocks with exposure to a weaker Australian dollar may also do well.

So the likes of Amcor Limited (ASX: AMC) and Transurban Group (ASX: TCL) should continue to receive buyer support.

However, the disastrous performance of 'fully franked dividend' poster boy Telstra Corporation Ltd (ASX: TLS) over the past 18 months shows how blindly buying shares for income without any regard to their profit growth prospects or management competence is a bad move.

As always the key to making good returns in the share market is to focus on quality companies at attractive valuations, before worrying about which way interest rates, or the Australian dollar might head over the short term.

Investors must also look for companies with consistent profit growth potential, rather than attempting to play perceived economic cycles.

If you're focused on dividends, I'd still give Australia's residential property leveraged major banks a miss in favour of quality operations with leverage to the health of the U.S. and wider global economy.

Tomorrow, Macquarie Group Ltd (ASX: MQG) is likely to provide a brief trading update at its AGM and it offers a good mix of yield, value and profit growth potential over say the next 3-5 years. It's the kind of stock I'd be interested in buying for higher income, but only after letting the market value it on tomorrow's update.

If you're more focused on growth over income the below business is still under-the-radar and also worth taking 5 minutes to read up on for FREE….