On Monday the Australian Bureau of Statistics released its latest tourism data for the month of April.

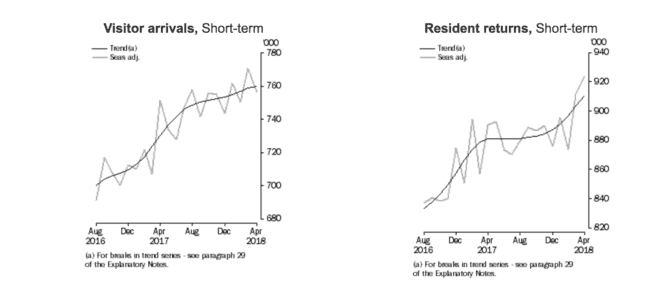

According to the release, Australia welcomed 759,900 short-term visitors in April, up 0.1% on the month of March and up 4% on the prior corresponding period.

In addition to this, there were 910,500 short-term resident returns during the month. This was an increase of 0.8% month-on-month and 3.3% on the prior corresponding period.

As you can see on the chart above, the tourism boom continues its impressive growth and shows no real signs of slowing any time soon. Which is great news for ASX shares that have exposure to the tourism sector.

With that in mind, should you be investing in these travel shares?

Corporate Travel Management Ltd (ASX: CTD)

Thanks to positive industry conditions and growing demand for corporate travel services, management expects Corporate Travel Management to achieve year-on-year EBITDA growth of approximately 27.5% in FY 2018. I believe this performance and the potential opportunities the company has to accelerate its growth through acquisitions in a highly fragmented market, means that 34x estimated forward earnings is a fair price to pay to own its shares. Though it is worth remembering that a failure to achieve the high expectations of the market could lead to a sharp share price decline.

Qantas Airways Limited (ASX: QAN)

The Qantas Airways share price has been one of the best performers on the market since the start of the year. During this time the airline's shares have risen almost 30% despite recent rises in oil prices. I believe that the airline's share price rise was more than deserved after it delivered an impressive half-year result. While I would say that Qantas' shares look about fair value now, a spot of insider buying this week through on-market trades might say otherwise.

Sydney Airport Holdings Pty Ltd (ASX: SYD)

As the main gateway into Australia I think Sydney Airport is one of the best options in the travel industry. Especially with its positive exposure to both the inbound and outbound tourism booms. Although I do have slight concerns that Sydney Airport could be caught up in a bond proxy selloff as bond yields widen, I am optimistic that its positive outlook for earnings and distribution growth will stop this from happening. But it certainly is a risk to consider before investing.