Retail property stocks are a tough sell these days as the sector is under a dark cloud with the growing popularity of online shopping impacting on mall traffic.

The sector is lagging the broader S&P/ASX 200 (Index:^AXJO) (ASX:XJO) as this structural challenge bites and things would be much worse if not for the takeover offer for Westfield Corp Ltd (ASX: WFD).

But it's not all doom and gloom for listed shopping centre owners and there is one that seems to be attracting favourable views from analysts in the wake of its profit result.

The stock is Vicinity Centres Re Ltd (ASX: VCX) after its new CEO and Managing Director, Grant Kelly, delivered his first profit announcement since taking over the helm. Australia's second largest retail property manager posted a 2.2% increase in first half adjusted funds from operations (FFO) to $357.7 million and declared an 8.1 cents a security interim distribution two days ago.

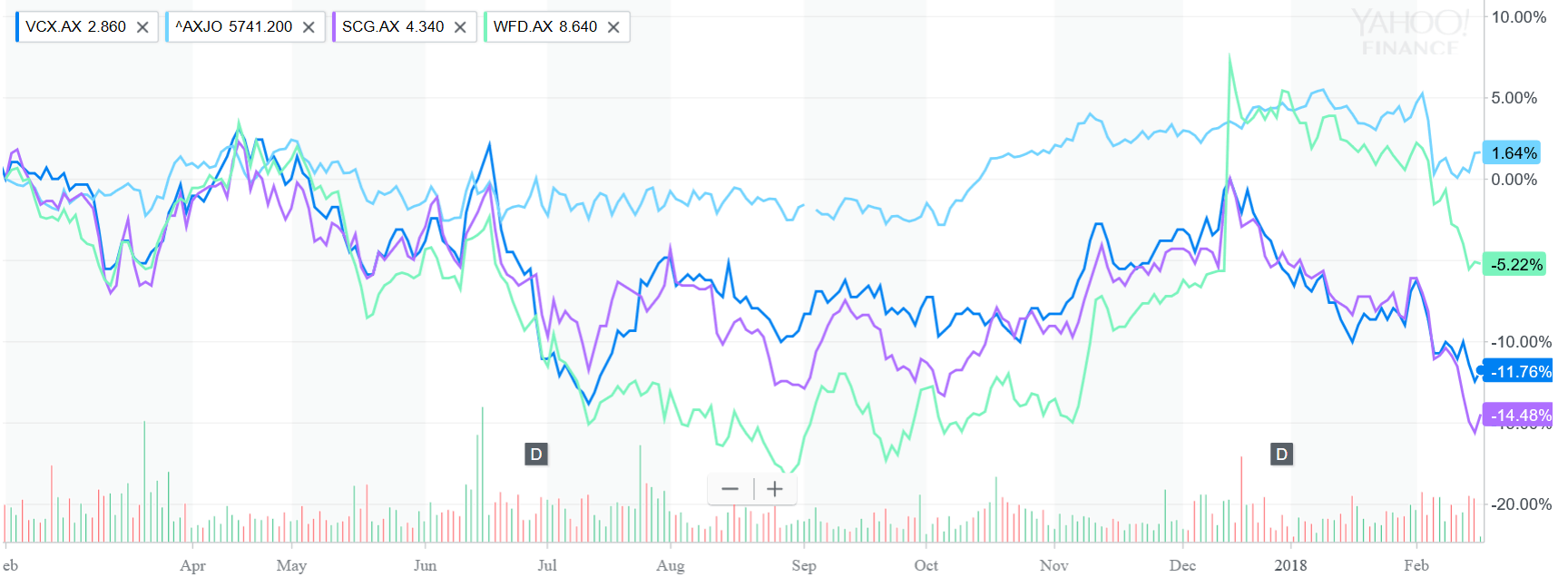

There is little doubt that the weak retail environment will continue to weigh on the stock but analysts are coming to the view that the bad news is more than reflected in the current share price, which has tanked 11.8% over the past 12-months when the top 200 stock benchmark is 1.6% in the black.

Out of Fashion: Share price performance of retail property stocks

Source: Yahoo Finance

Vicinity Centres isn't the only one in the sin bin. Scentre Group (ASX: SCG) has shed nearly 15% of its value while Westfield Corp has lost more than 5% over the same period.

Mr Kelly has also outlined plans to undertake mixed use development projects to help provide some diversification to Vicinity Centres' income stream. It's too early to ascribe much value to this strategy but even on the property trust's current business model, UBS thinks the stock looks cheap.

The broker notes that the stock is trading close to a 10% discount to its net tangible asset backing of $2.93 a share. This means the value of the shares are less than the value of its shopping centre assets.

What's more, the stock is trading on a yield of just over 6% for FY18 and UBS thinks it's a buy with fair value pegged at $2.92 a share.

The analysts at Shaw and Partners have a similar bullish view. While the results were in line with its forecasts, the broker points out that the occupancy rate remains high and company's gearing is conservative.

Shaw and Partners have a "buy" recommendation on the stock with a 12-month price target of $3.02.

Meanwhile, Macquarie Group Ltd (ASX: MQG) has downgraded its recommendation on the stock to "neutral" from "outperform" as it believes rising bond yields and persistently weak retail conditions will limit any upside to the stock.

However, its price target of $2.92 and 16.3 cents a share dividend suggests a more than 20% upside to the stock from its current price of $2.54.

If you are looking for stocks with more upbeat operating conditions, the experts at the Motley Fool have some good news for you.

They have uncovered a niche sector that is primed to make a big impact on investment markets in 2018 and beyond.

Click on the link below to get your hands on this free report and to find out what stocks are best placed to benefit from this investment thematic.