Speculative technology company GetSwift Ltd (ASX: GSW), which has already been in a trading halt for two days, today requested a voluntary suspension of its shares to give management additional time to respond to the ASX's queries. GetSwift went into trading halt following a Fairfax Media article over the weekend, which alleged that the company had failed to notify the market of the loss of material contracts.

GetSwift management stated that the contracts were not material. However, if they are, it could place GetSwift in an uncomfortable position as the company raised capital even though the market had not been notified of these contract losses. This could be what the ASX is querying GetSwift about, and may explain why the company entered a trading halt.

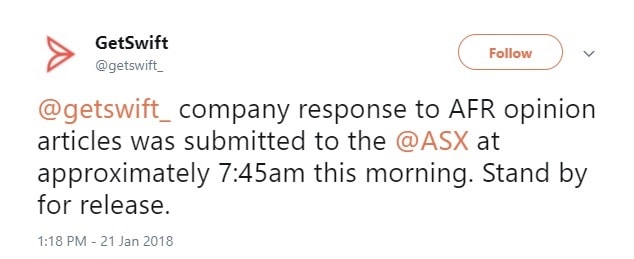

On Monday, GetSwift's official Twitter account tweeted that it had submitted a response to the ASX at 7.45am:

However, the subsequent two day trading halt and now suspension suggests that the ASX was not satisfied with the answers that GetSwift supplied, and requested additional information. Another possibility is that GetSwift is looking to delay its return to market until it can publish its latest quarterly, which is due out by the end of January. A strong quarterly report combined with a response to the ASX might allay some investor concerns and would allow the market to trade on the most informed basis possible.

GetSwift expects to release its announcement prior to the start of trade tomorrow, and we will have full coverage for you then.