Following the recent sale of its bowling and entertainment division for $160 million and the sale of its Marinas division earlier this year, Ardent Leisure Group (ASX: AAD) expects to be in a net cash position.

This will put the company in a prime position to roll out its Main Event entertainment venues across the USA, and indeed Ardent expects to change its name to reflect this in the coming months. So, is Ardent an opportunity?

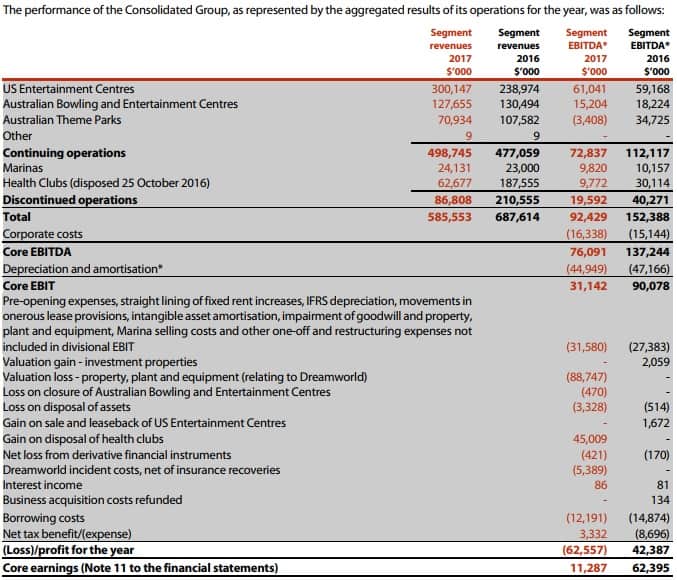

Ardent has a market capitalisation of around $900 million, valuing it at ~80x the company's core earnings from 2017, which admittedly were impacted by the Dreamworld disaster. I've long been bearish on Ardent, but the recent asset sales seemed a prime time to revisit my thoughts.

Even with a net cash position, Ardent looks expensive. Looking at the 2016 results (where Dreamworld made a full contribution):

Subtracting out the Bowling, Marinas, and Health Club segment, lowering depreciation and corporate costs, and then assuming a full contribution from Dreamworld and a certain amount of growth for the US Entertainment Centres business, Ardent still looks to have a forward enterprise value to EBITDA (EV/EBITDA) ratio of around 20 times.

A more normal multiple for this kind of business is around 8x-12x.

I use earnings before interest, tax, depreciation, and amortisation (EBITDA) because it specifically excludes interest expense, now that Ardent has (or will have soon) a net cash position.

The concern for me is that, while Ardent's Main Event opportunity is compelling and has a quick payback period, which should allow it to roll them out like new iPhones across the USA, competition and reinvestment in the centres could prove a concern.

Ardent has now reported two successive years of same-store sales decline at its existing centres, and margins have begun falling. While the company reports that these centres continue to deliver a return on investment above 30%, I assume that this is pre-refurbishment expenses, which could become increasingly important as centres seem to need refurbishing every 5 years or so.

I think Ardent is an interesting proposition, but for me the valuation is a bit too steep and the performance of the centres a bit too uncertain to make it an attractive investment at today's prices.