As in previous years, today I'm going to attempt to pick an unlikely trifecta of winners.

1) Whether the Reserve Bank of Australia (RBA) will move interest rates today.

2) A small-cap growth stock to out-perform the market over the next three years.

3) The winner of the 2017 Melbourne Cup.

#1 Interest rates on hold

The first bet is by far the easiest. Almost certainly the RBA will leave interest rates on hold today.

Given financial futures are suggesting an interest rate hike is not fully priced in until May 2019 at the earliest, you can put this one down as your banker.

#2 This exciting small cap's growth is accelerating

My small-cap growth stock to out-perform the market over the next three years is a stock I already own — fast growing fintech Praemium Ltd (ASX: PPS).

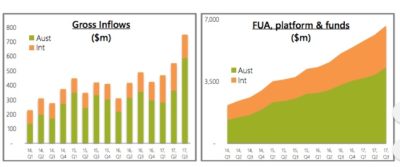

Praemium offers cloud-based software for investment platforms, portfolio administration, investment management, and CRM solutions with offices in the US, UK, Armenia, and Hong Kong. Praemium currently manage over $6.6 billion worth of funds globally across more than 300,000 accounts.

As you can see from the chart below, Praemium has been growing its funds under administration (FUA) at a rapid rate, with that rate accelerating to record levels in the most recent quarter.

Source: Company Presentation

The Praemium share price currently trades around 57 cents, up 39% in just the past 3 months. But don't let that put you off. This company has a long growth runway ahead, and is investing in growth now to "deliver sustainable and long-term returns to shareholders."

As ever, there are risks. Competitive risks are never far away — there are plenty of other investment administration and financial planning technology platform companies out there. A sustained bear market will undoubtedly hurt Praemium. And the shares are not cheap, trading on a forward P/E of around 27 times earnings.

Finally, any investment in Praemium should be made as part of a diversified portfolio, made up of between 15 – 30 stocks. I've put Praemium in the small-cap sleeve of my portfolio, alongside a number of other exciting, fast growing ASX stocks.

# 3 The Melbourne Cup

For the Melbourne Cup, as ever, I've enlisted the help of Lewy, the Fool's resident horse racing pundit.

He was bang on the money in 2011 when he tipped Dunaden. In 2015 Protectionist was amongst his top three selections. The last two years he has drawn blanks. Either you could say he's due a winner, or he got lucky with Dunaden and he's a dud tipster.

Ever the optimist, I'm going with the former, plonking down my standard $5 each way bets on each of the three nags below. Over to Lewy…

This year's Melbourne Cup looks as challenging as any in recent memory. The shortest priced horse in the field is currently $8 – that's about as wide open as the Cup gets!

That horse incidentally, is Marmelo. He's the one I like. His Caulfield Cup trial stands outs as the best local lead up and importantly, he looks to have acclimatised to our unforgiving tracks and conditions.

Vintage Crop ('93) remains the only import to win the Cup without a local lead up run. Conversely, 3 of the last 7 Cup winners have been foreign raiders who rounded out their preparations with solid local lead ups.

Marmelo profiles well. He's lightly raced and endowed with a touch of class. The race he won in France in August – the Kergolay – just happens to have provided 3 of the last 6 Cup winners.

Alas, there's no shortage of dangers. Topping the list is last year's winner Almandin ($10). Yes, he rises in weight – penalised for his impressive victory in 2016. Offsetting this, he looks to have improved. I'd rather have him with me than against.

Rounding out my Cup suggestions is another foreigner with a solid local hit out on his CV – Wall of Fire ($13). He barely scraped into the field but profiles as the less flashy genuine stayer, likely to be closing strongly late.