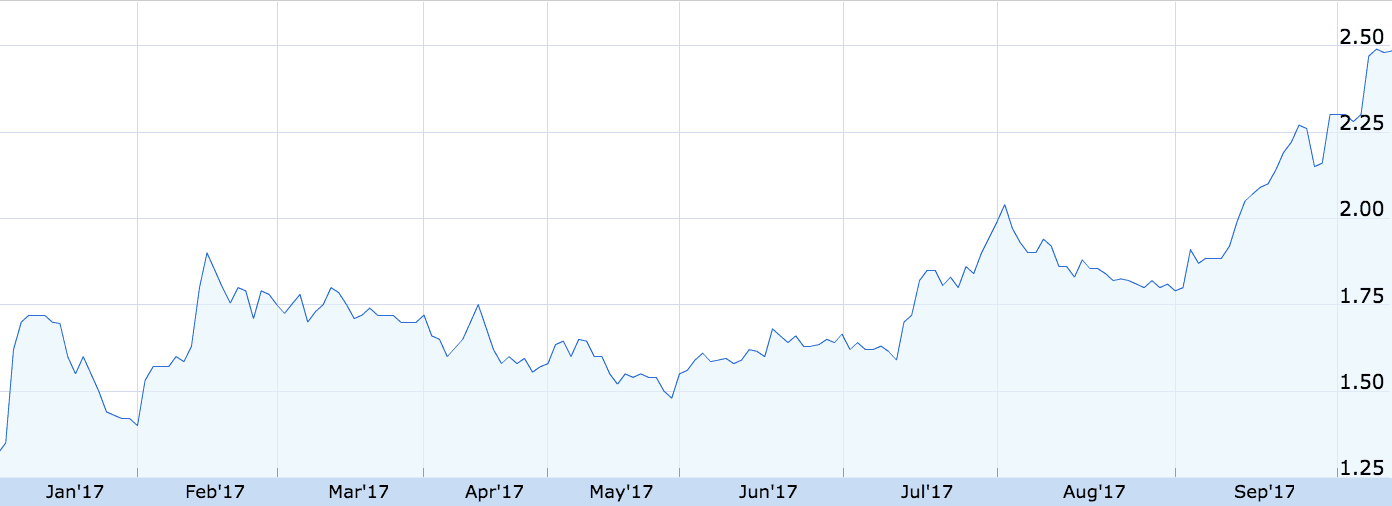

The PUSHPAY FPO NZX (ASX: PPH) share price has surged today following a market update this morning.

Pushpay Holdings Share Price

What happened?

In an announcement to the ASX this morning, Pushpay, a leader in church donation payment processing software, reported an updated financial outlook. The company services 50 of the 100 largest churches in the US, based on a study by Outreach Magazine.

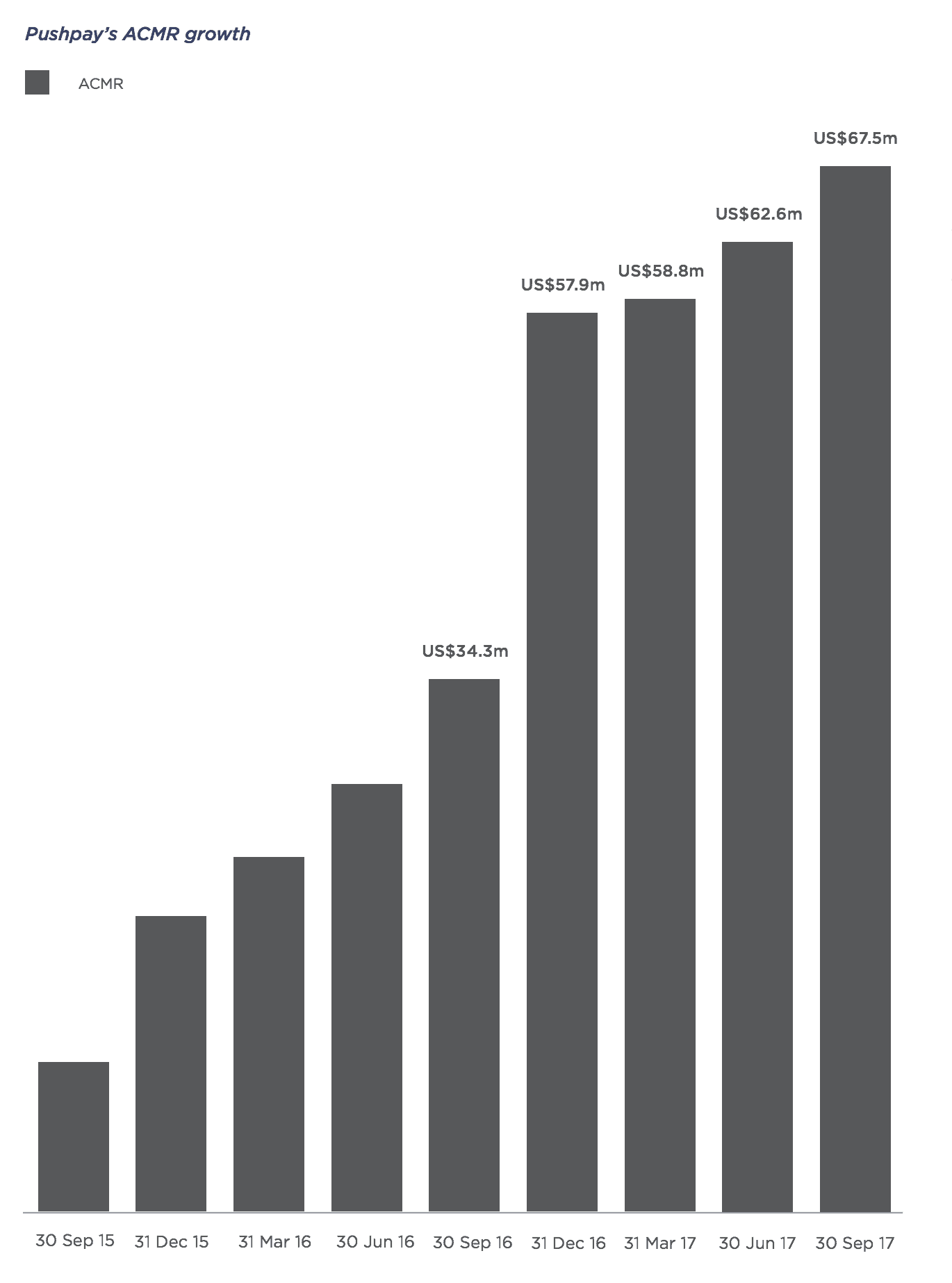

Today, Pushpay brought forward its annualised committed monthly revenue (ACMR) target of US$100 million to 31 December 2017.

"Pushpay continues to secure its market leading position in a growing sector and has subsequently brought forward its US$100 million ACMR target from 31 March 2018 to 31 December 2017," Pushpay CEO Chris Heaslip said. "US$100 million ACMR is a significant milestone in our Company's journey and our new target date means Pushpay will be achieving this milestone within 27 months after reaching US$10 million ACMR."

"Our goal is to reach the milestone of US$10 billion in Annualised Monthly Payment Transaction Volume, representing less than 10% of annual giving to religious organisations in the US."

Pleasingly, the company said it was on track to meet its revenue guidance of US$70 million and monthly breakeven cash flow by the end 2018.

Foolish Takeaway

Religion and technology. Two sectors which have proven to be extremely lucrative for nonprofits and for-profits alike.

Although Pushpay shares have rallied strongly in 2017 — and despite the company's shares trading at eight times its sales — I think Pushpay deserves to be on your investing watchlist in 2017.