Since November 2016, I have made three new share market investments: Vanguard MSCI Index International Shares (Hedged) ETF (ASX: VGAD), Platinum Asset Management Limited (ASX: PTM) and Apple Inc. shares.

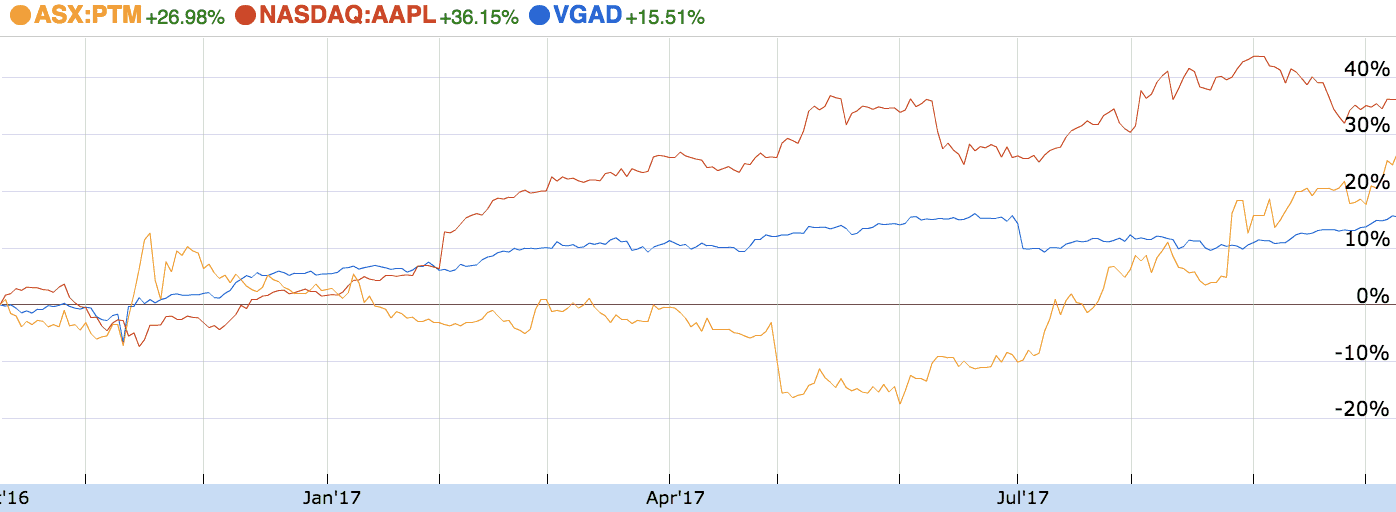

Here's how they have fared in recent times:

Apple Inc v. Platinum v. Vanguard International Shares ETF

I bought Apple, the world's largest company, for $111 in November 2016 — it's now $155.

I bought Platinum in May, it's up 50% including dividends.

I bought the Vanguard ETF for my little sister (which we will later roll into an investment bond) in April – up 4.2%, not including dividends.

Something interesting

I'm not trying to butter my own bread. I'm merely trying to use these investments as a good example of something that I have learned about myself and investing in recent years.

It's this: the less you do, the more you make.

Aside from that one year when I got lucky and made 13x my money on a single investment, the last 12 months have been the most rewarding of my investment lifetime.

But, it has also been my least active investment year by a factor of more than 100%. Meaning, I've made more money yet I have done far less.

I think it comes back to a few things:

- Buying only the best companies I can find. Before I was making good investments. Now, I'm reserving my money for great (or better) opportunities. It brings peace of mind when things go pear-shaped.

- Leaving my money alone. Prior to this 12-month period, if I had made 20%, 40%, $2,000 or $10,000 from a single investment I would have been tempted to take at least some of my cash and run. I'm not as bothered anymore. Since I only invest in great companies, which are the types of companies one holds for 10 years or more, I'm not bothered with trying to time my buying and selling year-to-year.

- It's been a good time to invest. Despite all the intellectual naysayers and doomsday prepping on television, the financial world is yet to implode. But even if does — like it did in 2008 — I have accepted that everything will be ok.

Foolish Takeaway

It's almost unbelievable to think that shares in the biggest company in the world (Apple) have increased 40% in less than a year, not including dividends. At the time I bought my Apple shares they were trading at just 13x their profit.

It's crazy to think what the market will throw up when you are prepared to be a little more patient.