In the year ahead, National Australia Bank Ltd. (ASX: NAB) shares are forecast to pay dividends equivalent to 6.3% fully franked.

NAB share price

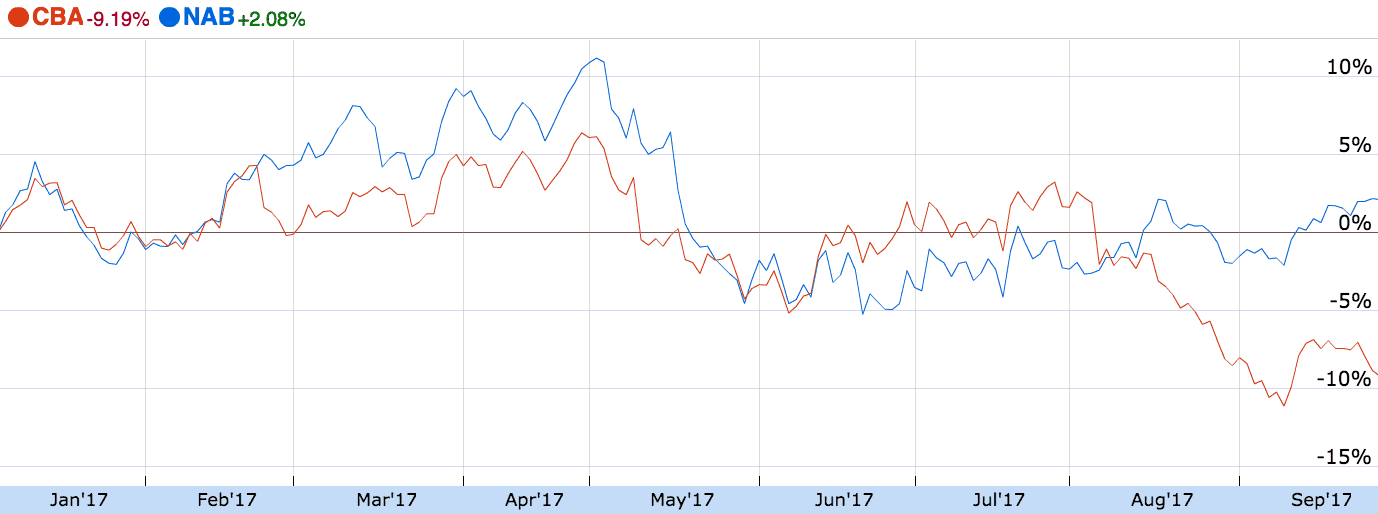

After reaching a high of $34 earlier this year, NAB shares dropped below $30 as investors feared a slowing housing market, increasing Australian interest rates and regulation would hurt its growth prospects.

Are NAB shares a buy?

Following the divestment of its UK and US banking assets, NAB also sought to sell 80% its insurance business. Each of these moves was part of the bank's strategy to divest non-core businesses and focus on its strongest operations in Australia and New Zealand, its business and retail banking.

With the divestment of its struggling overseas businesses, NAB is a leaner and more efficient company. In my opinion, the divestments bode well for the company going forward.

However, given the sluggish growth in the economy and a recent surge in house prices, I think revenue growth will be more modest in coming years.

In August, the company provided its third-quarter trading update reporting a profit of $1.7 billion, up 5% year over year. It also reported further declines in bad debt charges. Together with its strong capital position, these results were encouraging to income-seeking investors, who were fearful that regulatory headaches might see the bank cut its dividends.

Ultimately, growth was in-line with expectations. But in my opinion, the outlook for the bank is not rosy enough to justify NAB's high valuation.

Foolish Takeaway

NAB's dividend yield is enviable, especially with interest rates on term deposits so low. However, I'm not in a rush to buy its shares since its valuation is not very compelling at today's prices. Instead, I have NAB shares planted firmly on my watchlist.