The Kathmandu Holdings Ltd (ASX: KMD) share price is 6 per cent higher in morning trade after the outdoor adventure retailer reported its financial results for the full year ending 31 July, 2017.

Below is a summary of the results with all figures in NZ dollars and comparisons to the prior corresponding period where relevant.

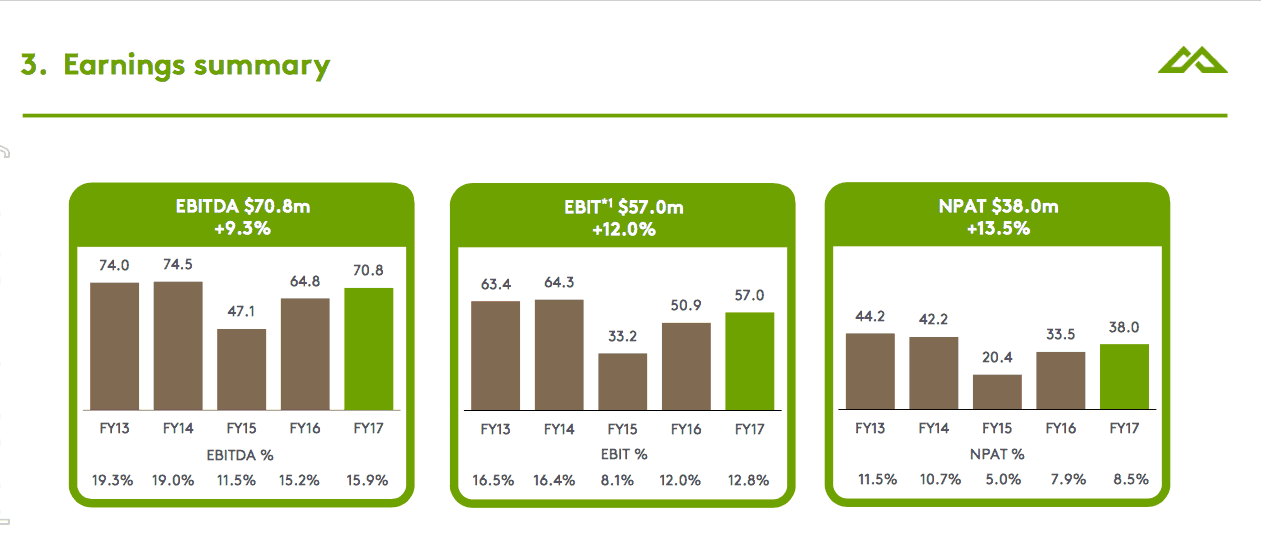

- Revenue of $445.4 million, up 4.6%

- Net profit of $38 million, up 13.5%

- EBIT of $57 million, up 12%

- Net debt fell $29.9 million to $6.9 million

- Final dividend of 9 cents per share, full year payout will be 13 cents per share, up 18.2%

- Diluted earnings per share of 18.7 cents

- Gross sales margin fell 60 basis points to 62%

- Same store sales (SSS) up 5.5%, Australian SSS up 6.9%

As an outdoor and winter sports retailer Kathmandu rules off its books after the key autumn / winter trading season and has produced a decent year of growth, despite challenging retail conditions across Australia and New Zealand.

Total revenues creeped higher thanks mainly to new store openings and renovations, while the key profit margins were flat as modestly rising costs of doing business such as rent and labour offset cheaper souring costs and higher store prices for new products.

Varying margins as a result of promotional discounting and changing consumer confidence have seen Kathmandu's annual profits swing widely over the last four years. As can be seen from the chart below showing its earnings between FY13 to FY17.

Source: Kathmandu investor presentation.

As a result of the lumpy profits the share price has delivered more ups and downs than a Himalayan footpath over the past 5 years and the question for investors now is whether it can consistently climb higher from today's level of A$2.09?

Kathmandu has a strong brand, has paid down debt, and serves a niche market that may be less vulnerable to online competition, but whether it can deliver consistent earnings growth over a 5-year time horizon is tough to know.

The uncertain outlook is reflected in a valuation of around 12.3x trailing FX-adjusted earnings per share of around A17 cents, with a trailing FX-adjusted dividend yield over 5%.

As such the stock is not expensive, but nor is it cheap, and in the beaten-down retail space on current valuations I would rather go bargain-hunting for shares in footwear retailer RCG Corporation Ltd (ASX: RCG) . They change hands for 70 cents today on 9.5x earnings with a trailing yield of 8.5%.

RCG Corp also has a long track record of profit growth with management confident of another year of growth. If the stock gets any cheaper I'm a buyer of RCG when trading restrictions permit, while Kathmandu is one to watch from the sidelines in my opinion.